Vox clamantis in deserto

National cross-section

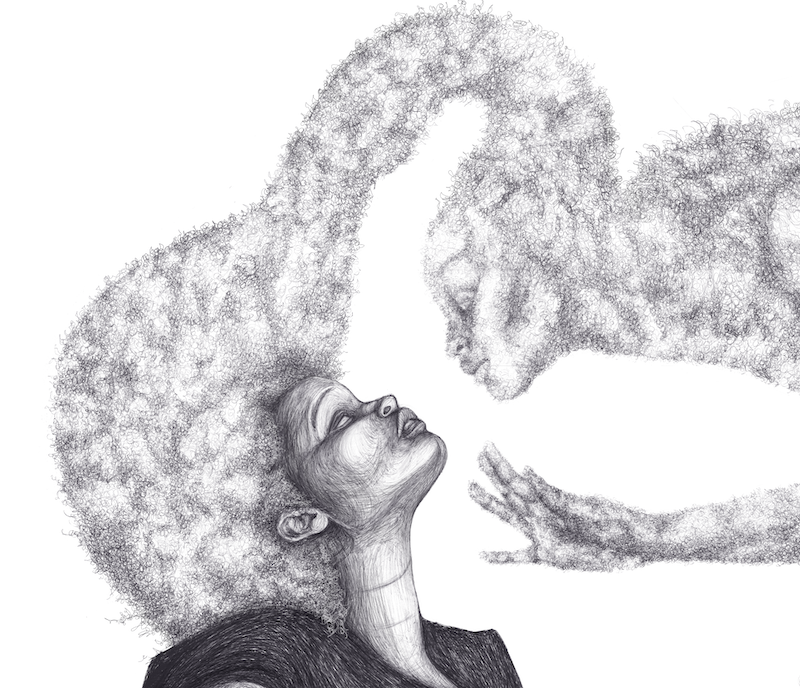

From the show “August Sander’s People of the 20th Century,’’ at the Yale University Art Gallery, New Haven, Conn., opening Feb. 27.

The show presents the fullest expression of the German photographer August Sander’s (1876-1964) career-long work: a monumental endeavor to amass an archive of 20th Century humanity through a cross-section of German culture.

Chris Powell: Yale has gotten too big for its New Haven property-tax break

Yale’s Old Campus at dusk in April 2013.

MANCHESTER, Conn.

If any news report in Connecticut this year should prompt an urgent response from state government, it's the one published last week by the Hearst Connecticut newspapers about the burden of Yale University's property-tax exemption in New Haven.

It's actually an old story but one that has never gotten proper attention from Connecticut governors and state legislators.

The essence of it is that most real estate in New Haven, being owned by nominally nonprofit entities, is exempt from municipal property taxes; that most of this exempt property is owned by Yale; and that the university, while being New Haven's largest employer and the city's main reason for being, is less of a boon than generally thought.

According to the Hearst report, the university's taxable property in New Haven, property used mainly for commercial purposes, has total value of $173 million while its tax-exempt property, used mainly for educational purposes, is valued at around $4.4 billion.

Yale pays the city $5 million annually in taxes on its taxable properties and another $22 million or so in voluntary payments for its exempt properties, or about $27 million. But without its property-tax exemption Yale would owe New Haven as much as $146 million more than the university pays now.

Of course there's no denying Yale's enormous economic contribution to New Haven and its suburbs. Without Yale, New Haven would be Bridgeport, whose reason for being, as long assumed by state government, is mainly to confine Fairfield County's poverty.

But Yale's relationship with New Haven has gotten far beyond disproportionate. As a political force the university is bigger than the city and, it seems, since state government has not acted against that disproportion, bigger than the whole state.

It's not that Yale can't afford to pay more; it has an endowment of around $40 billion, which even President Trump and the Republican majority in Congress have found the courage to begin taxing.

Nine years ago the General Assembly considered legislation to limit the university's tax exemption but did not act.

Yale has claimed that the charter that it received from Connecticut's colonial legislature in the 1700s gives the university permanent exemption from property taxes.

But the charter and its revisions under state law during the next two centuries put limits on Yale's tax exemption, the first limit being a mere 500 pounds sterling. The tax exemption was thought justified in large part because, in its early years, Yale was heavily subsidized by cash from state government and was a de-facto government institution. A remnant of this connection to state government is the continuing “ex-officio" membership of Connecticut's governor and lieutenant governor on the university's Board of Trustees.

Yale no longer gets a direct annual cash stipend from state government but its $173 million tax break is worth a lot more. That money is paid not just by New Haven's residents through their property taxes and rents but by all state taxpayers as well, since New Haven city government is so heavily subsidized by state government.

Even if the courts concluded that the university's charter, as amended over the years, puts it beyond all property taxes on educational buildings, state government could coerce Yale by restricting the acreage it owns in the city, thereby forcing it to sell property and rent it back.

Would Yale leave Connecticut if, as was proposed nine years ago, state law limited university property-tax exemptions to $2 billion per year, thereby raising Yale's annual tax bill by $70 million or so? Yale's huge endowment implies otherwise.

At least the new federal tax on large university endowments has not prompted the richest schools to start planning to leave the country.

The additional property-tax revenue paid by Yale could be divided equally between New Haven and state government, state government recovering its share by reducing its financial aid to the city.

Of course those governments probably wouldn't spend the windfall very well, but it's the principle of the thing.

Chris Powell has written about Connecticut government and politics for many years (CPowell@cox.net).

Southwest Airlines’ $10 million pledge to Yale to research natural carbon capture

From The New England Council (newenglandcouncil.com)

“Southwest Airlines, announced a $10 million commitment to New Haven-based Yale University’s Center for Natural Carbon Capture (YCNCC) to research technological advancements and find new solutions to reduce net greenhouse-gas emissions.

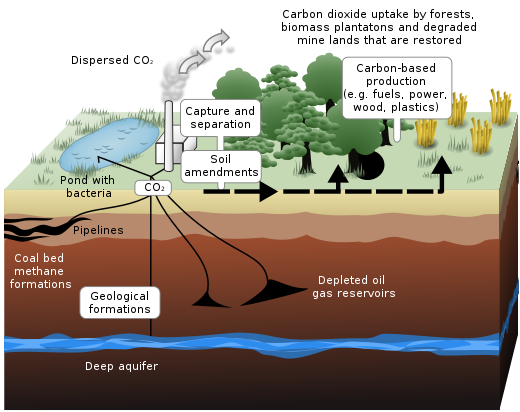

“The pledge will also support research and educational efforts at the Yale School of the Environment to explore the current state of sustainability, strategy, policy, and economics, emphasizing trends related to the aviation industry and focusing on finding new ways to reduce atmospheric carbon. Established in March 2021, YCNCC is focused on strategies for removing carbon dioxide from the atmosphere and safely storing it within plants, soils, rocks, and oceans. It also aims to develop methods for industrial carbon capture to convert carbon dioxide into useful fuels, plastics, and building materials.

“‘This innovative partnership gives Southwest the opportunity to support the development of crucial science to combat climate change, including fostering innovative research aimed at informing and advancing efforts to reduce atmospheric greenhouse gas concentrations,’ said Stacy Malphurs, vice president of supply chain management & environmental sustainability for Southwest Airlines. We recognize the importance of supporting initiatives that take a holistic approach to de-carbonization in the long-term, which aligns with the U.S. government’s goal for the aviation industry to be carbon neutral by 2050.’