Lovely fatalism

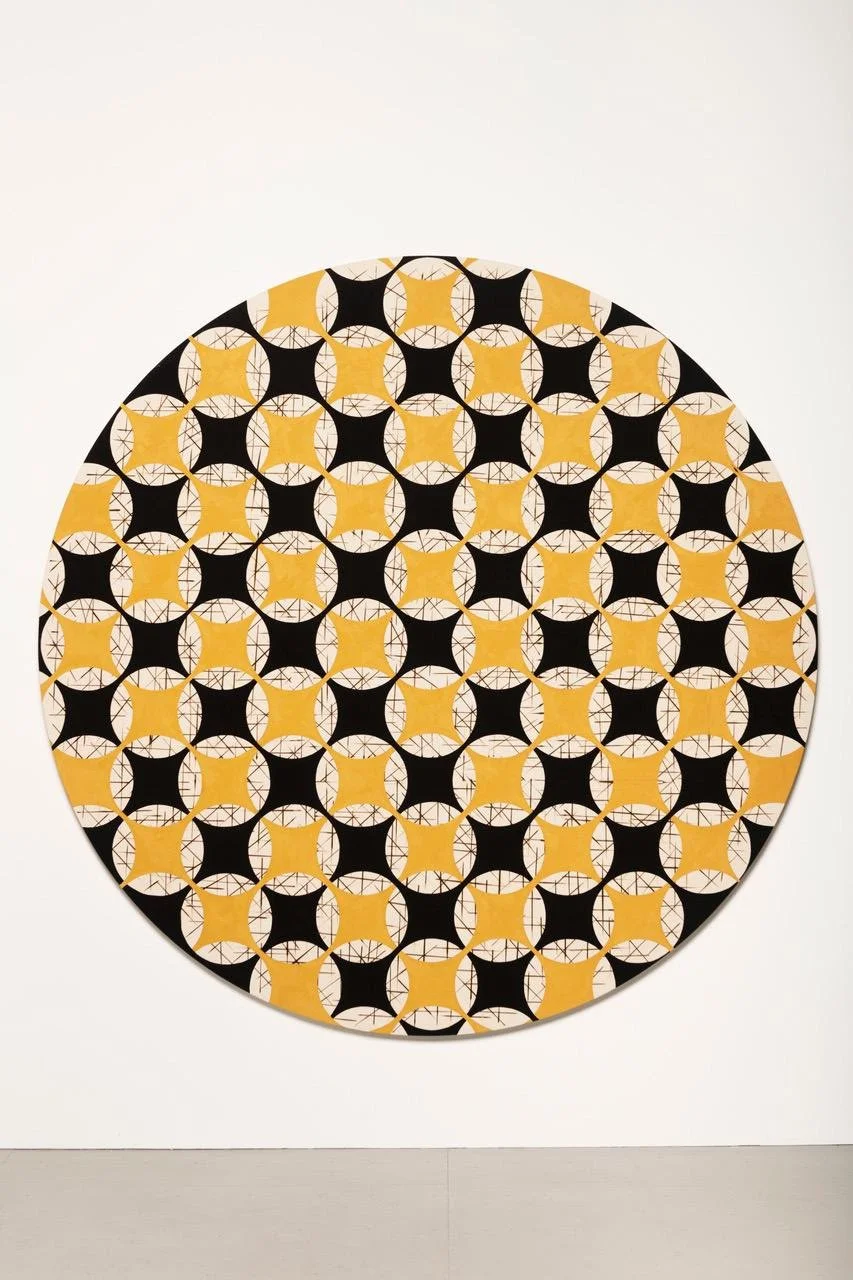

“Amen, so be it” (oil on canvas), by Boston-based artist Jennifer Jean Okumura, at Project B Gallery, Framingham, Mass., through July 10.

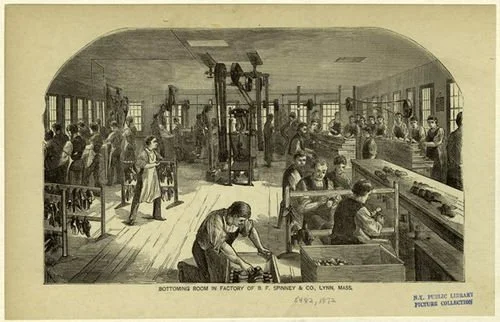

We still make 'em

New Balance running shoes

Early 19th Century shoemaking shop displayed at the Maine State Museum, in Augusta

By the mid to to late 19th Century, the shoemaking industry had migrated to the factory and was increasingly mechanized. Here’s the bottoming room of the B. F. Spinney & Co. factory, in Lynn, Mass., in 1872

The shoe industry was once huge in New England. It was concentrated in eastern Massachusetts, particularly in Lynn and Brockton, but Maine and New Hampshire had shoemaking centers, too. And some of the companies that served the industry were big, too— most notably United Shoe Machinery Corp., based for decades in its Art-Deco skyscraper on Federal Street in downtown Boston. But by the mid-20th Century, much of the industry had moved south, in search of cheaper labor. But a few shoe companies remain in the region.

The following is edited from a New England Council report:

“New Balance, the Boston-based footwear maker, opened manufacturing facilities in Skowhegan, Maine, and Londonderry, N.H., as part of its efforts to expand U.S. manufacturing capacity. The company aims to enhance its American supply network through innovation, automation] and robotics.

“With the $65 million Skowhegan expansion, New Balance will add a 120,000-square-foot single-story addition to the existing facility, doubling production capabilities and creating 200 new jobs. Additionally, the Londonderry facility would cover 102,418 square feet and includes office and manufacturing space, seven loading docks, and LED lighting. New Balance expects to hire 250 employees initially and up to 450 upon completion of the project.

“‘ New Balance has always been strongly committed to the communities where our associates live and work,’ said Raye Wentworth, director of domestic manufacturing at the company. ‘We’re thrilled to be able to support this important opportunity to add quality, affordable education and child-care resources for local families.”

An ad for the long-gone, high-end Brockton, Mass.-based shoemaker the Geo E. Keith Co., whose famous trade name was Walk-Over

#New Balance

#shoemaking

Chris Powell: Conn. junket in Paris? Another wrongful conviction

Advertisement for Sikorsky S-42 Clipper flying boat from 1937.

Sikorsky Aircraft , based in Stratford, Conn., was established by aviation pioneer Igor Sikorsky in 1923 and was among the first companies to manufacture helicopters for civilian and military use. Its UH-60 Black Hawk below.

Headquarters of Pratt & Whitney, the aerospace company, in East Hartford, Conn.

MANCHESTER, Conn.

With about 34,000 of its residents employed in the aerospace industry, Connecticut had good reason to be represented at the Paris Air Show this past week, so Gov. Ned Lamont was there with a delegation of state officials and business leaders.

“Our goal," the governor says, "is to get more products that are made in Connecticut out into the world, and to get more of the world doing business in Connecticut.”

Some time may pass before Connecticut learns whether the excursion was a serious attempt at business development or just a junket.

Besides the concentration of aerospace businesses here, the state's advantages to the industry are said to include its strategic location between New York and Boston, the great life in its suburbs, its skilled manufacturing workforce, and the quality of its products.

Yet business leaders from around the world who come to the air show more for business than junketing may be prepared to inquire beyond the conventional wisdom.

They might ask about the recent inability of Connecticut manufacturers to find qualified people and the growing share of the workforce emerging uneducated from the state's schools and suited only for menial work.

They might ask about the state's high taxes and particularly the recent extension of its 10 percent surcharge on the corporation income tax.

They also might ask about the state's high housing costs and severe shortage of housing for working people. If a foreign company wanted to open a facility in Connecticut with 200 or more employees, exactly where could enough housing be found for them near the new company? Even if the new company was willing to build housing for its employees, would any municipality welcome it or just obstruct it with zoning?

If they face such serious questions in Paris, Connecticut's delegation well might prefer to linger at the Eiffel Tower, the Louvre, or any croissant shop.

xxx

Connecticut has another catastrophic and likely expensive wrongful conviction case -- that of Adam Carmon, who served 28 years in prison on a charge of firing a dozen bullets into an apartment in New Haven in 1994, killing a baby and paralyzing her grandmother.

In November Superior Court Judge Jon Alander reversed Carmon's convictions and ordered a new trial. Last week the New Haven prosecutor's office dropped the charges, having concluded that the evidence for them won't stand up a second time -- eyewitness identification that was shaky and ballistics evidence that has been repudiated. Additionally, the judge concluded that the prosecution withheld from the defense evidence suggesting that two purported drug dealers could have done the shooting and that the police failed to pursue other suspects, including a man who confessed and then recanted.

No motive for Carmon to commit the crime was ever offered.

So Judge Alander has dismissed the case, telling Carmon, "The criminal- justice system failed you."

For the 28 years taken from him, Carmon is entitled to file a damage claim against the state and to sue the agencies that investigated and prosecuted him. He probably has at least $5 million coming to him, though few people would exchange 28 years for any amount.

The criminal-justice system also seems to have failed a disturbing number of others in recent years, especially in the New Haven area. Critics point to a dozen other overturned convictions involving complaints of police and prosecutor misconduct from the 1980s through the early 2000s. They want a federal investigation.

Investigation is very much warranted but not by the federal government, now that the U.S. Justice Department and Federal Bureau of Investigation have been so corrupted politically.

No, the investigation here should be conducted by Connecticut's own authorities, and particularly by the General Assembly, which has broad authority over the operations of state government, including criminal justice, but seldom investigates or even audits anything, though the other day it asked state agencies to study the urgent matter of adding "non-binary" to the gender identification sections of their license and application forms.

Chris Powell has written about Connecticut government and politics for many years. (CPowell@cox.net)

#aerospace

What to do?

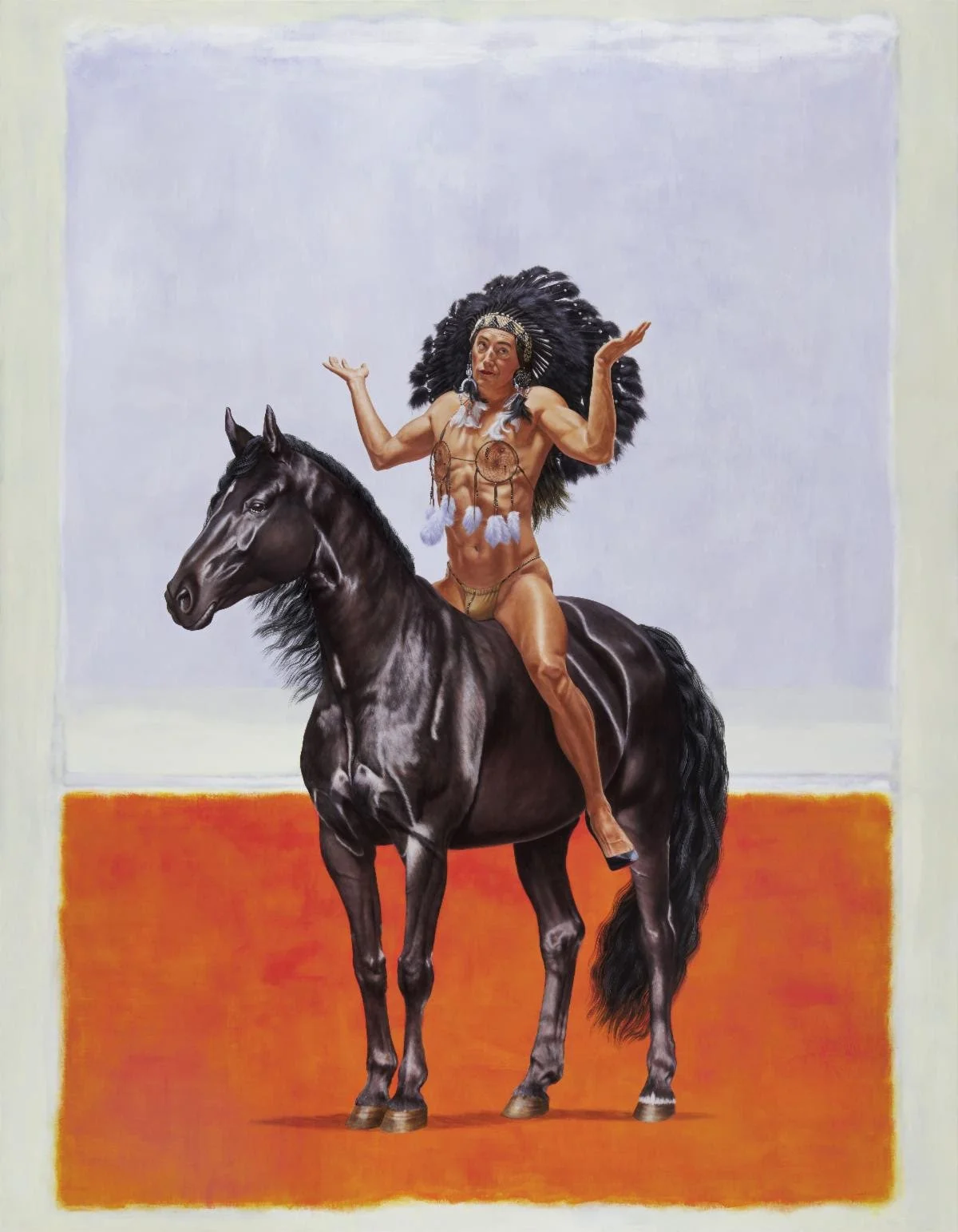

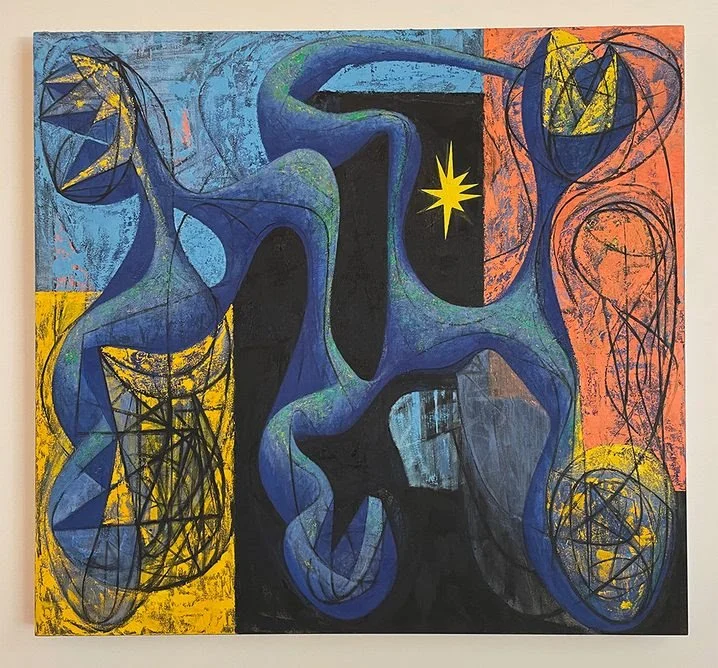

“The Great Mystery” (acrylic on canvas), by Canadian artist Kent Monkman, in his show “Kent Monkman: The Great Mystery,’’ at the Hood Museum of Art, at Dartmouth College, Hanover, N.H. , through Dec. 16.

The exhibition features a new body of paintings by Monkman, a member of the Cree nation —including two commissioned works for the Hood Museum of Art's permanent collections.

FYI: Dartmouth began as a school for Native Americans in Connecticut in 1754.

But quakes do happen

An 18th-Century woodcut taken from a religious tract showing the effects in Boston of the Cape Ann Earthquake, on Nov. 18, 1755. The earthquake’s epicenter was just off Cape Ann and is believed to have been between 6.0 and 6.3 on the Richter scale, making it a powerful quake. It did major damage on Cape Ann and in Boston and remains the largest measured earthquake in Massachusetts so far.

“When Benjamin Franklin invented the lightning-rod {in 1749} the clergy, both in England and America, …. condemned it as an impious attempt to defeat the will of God. For, as all right-thinking people were aware, lightning is sent by God to punish impiety or some other grave sin—the virtuous are never struck by lightning. Therefore if God wants to strike any one, Benjamin Franklin [and his lightning-rod] ought not to defeat His design; indeed, to do so is helping criminals to escape. But God was equal to the occasion, if we are to believe the eminent Dr. Price, one of the leading divines of Boston. Lightning having been rendered ineffectual by the 'iron points invented by the sagacious Dr. Franklin,' Massachusetts was shaken by earthquakes, which Dr. Price perceived to be due to God's wrath at the 'iron points.' In a sermon on the subject he said, 'In Boston are more erected than elsewhere in New England, and Boston seems to be more dreadfully shaken. Oh! there is no getting out of the mighty hand of God.' Apparently, however, Providence gave up all hope of curing Boston of its wickedness, for, though lightning-rods became more and more common, earthquakes in Massachusetts have remained rare.”

— Bertrand Arthur William Russell, 3rd Earl Russell, (1872-1970) was a British mathematician, philosopher, logician and public intellectual.

#Cape Ann Earthquake

Don’t be a slob, become president

John Quincy Adams as a young man

“You come into life with advantages which will disgrace you if your success is mediocre. And if you do not rise to the head not only of your own profession, but of your country, it will be owing to your own laziness, slovenliness and obstinacy.“You come into life with advantages which will disgrace you if your success is mediocre. And if you do not rise to the head not only of your own profession, but of your country, it will be owing to your own laziness, slovenliness and obstinacy.’’

— Then Vice President (and the next President) John Adams (1735-1826) to his son John Quincy Adams (1767-1848), then a teenager, in 1794. John Quincy Adams managed to become secretary of state, president and congressman, in which job he led the opposition to slavery. Both Adamses are buried at the United First Parish Church, in Quincy, Mass.

‘When I feel a little shiver’

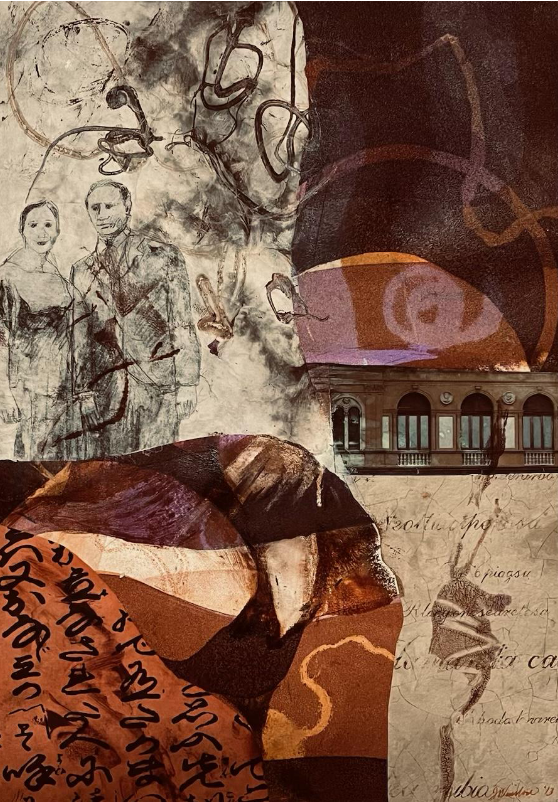

“Throw Roses in the Rain” (mixed media diptych with acrylics on panel), by Deborah T. Colter, at Atelier Newport, though July 22.

She says:

“My work currently speaks to my infatuation with process and exploration. Painting allows me to discover places that feel both familiar and unknown. Often I feel the work arrives out of nowhere as if sent from a place beyond my knowledge. I deeply trust in the messy process of creating, with all its inherent bumps and wrinkles, which helps me understand my need to continue on this creative path.

“When a piece begins to coalesce and I feel a little shiver run down my spine, it is then that I understand the painting has taken on a life of its own.’’

She lives on Martha’s Vineyard

The Old Whaling Church , in the Edgartown Village Historic District, on the eastern side of Martha’s Vineyard. Built with whaling captains’ money in 1843, this stately landmark is considered one of the finest examples of Greek Revival architecture in the country.. The second quarter of the 19th Century was the heyday of the whaling industry, which was centered in southern New England.

# Deborah T. Colter

#Atelier Newport

Sarah Boden: Dementia can cause financial disasters

Comedian and movie star Robin Williams (1951-2014) in 2011). His widow said he was diagnosed on autopsy with Lewy body dementia.

This article is from a partnership that includes WESA, NPR and KFF Health News.

NEW HAVEN, Conn.

Angela Reynolds knew that her mother’s memory was slipping, but she didn’t realize how bad things had gotten until she started to untangle her mom’s finances: unpaid bills, unusual cash withdrawals, and the discovery that, oddly, the mortgage on the family home had been refinanced at a higher interest rate.Looking back, Reynolds realizes her mother was in the early stages of Alzheimer’s disease: “By the time we caught on, it was too late.”

Reynolds and her mother are among a large group of Americans grappling with the financial consequences of cognitive decline.

A growing body of research shows money problems are a possible warning sign — rather than only a product — of certain neurological disorders. This includes a 2020 study from Johns Hopkins University of more than 81,000 Medicare beneficiaries that found people with Alzheimer’s and related dementias became more likely to miss bill payments up to six years before a formal diagnosis.

The reach of these conditions is enormous. One recent study found nearly 10% of people over age 65 have dementia; more than twice as many are living with mild cognitive impairment..

One weekday in the spring of 2018, Reynolds sat next to her 77-year-old mother, Jonnie Lewis-Thorpe, in a courtroom in downtown New Haven. She listened in discomfort as strangers revealed intimate details of their own finances in a room full of people waiting their turn to come before the judge.

Then it hit her: “Wait a second. We’re going to have to go up there, and someone’s going to be listening to us.”

That’s because the family home was in foreclosure. The daughter hoped that if she explained to the judge that her mother had Alzheimer’s disease, which had caused a series of financial missteps, she could stop the seizure of the property.

Reynolds can’t pinpoint when Alzheimer’s crept into her mother’s life. A widow, Lewis-Thorpe had lived alone for several years and had made arrangements for her aging, including naming Reynolds her power-of-attorney agent. But Reynolds lived a 450-mile drive away from New Haven, in Pittsburgh, and wasn’t there to see her mom’s incremental decline.

It wasn’t until Reynolds began reviewing her mother’s bank statements that she realized Lewis-Thorpe — once a hospital administrator — had long been in the grip of the disease.

Financial problems are a common reason family members bring their loved ones to the office of Robin Hilsabeck, a neuropsychologist at the University of Texas at Austin Dell Medical School who specializes in cognitive issues.

“The brain is really a network, and there are certain parts of the brain that are more involved with certain functions,” said Hilsabeck. “You can have a failure in something like financial abilities for lots of reasons caused by different parts of the brain.”

Some of the reasons are due to normal aging, as Reynolds had assumed about her mother. But when a person’s cognition begins to decline, the problems can grow exponentially.

Dementia’s Causes and Ruthless Impacts

Dementia is a syndrome involving the loss of cognitive abilities: The cause can be one of several neurological illnesses, such as Alzheimer’s or Parkinson’s, or brain damage from a stroke or head injury.

In most cases, an older adult’s dementia is progressive. The first signs are often memory slips and changes in high-level cognitive skills related to organization, impulse control, and the ability to plan — all critical for money management. And because the causes of dementia vary, so do the financial woes it can create, said Hilsabeck.

For example, with Alzheimer’s comes a progressive shrinking of the hippocampus. That’s the catalyst for memory loss that, early in the course of the disease, can cause a person to forget to pay their bills.

Lewy body dementia is marked by fluctuating cognition: A person veers from very sharp to extremely confused, often within short passages of time. Those with frontotemporal dementia can struggle with impulse control and problem-solving, which can lead to large, spontaneous purchases.

And people with vascular dementia often run into issues with planning, processing, and judgment, making them easier to defraud. “They answer the phone, and they talk to the scammers,” said Hilsabeck. “The alarm doesn’t go off in their head that this doesn’t make sense.”

Jonnie Lewis-Thorpe, a widow who now has Alzheimer’s disease, had made arrangements for her aging, including naming daughter Angela Reynolds as her power-of-attorney agent. But Reynolds lived 450 miles away and wasn’t there to see her mom’s incremental decline.

For many people older than 65, mild cognitive impairment, or MCI, can be a precursor to dementia. But even people with MCI who don’t develop dementia are vulnerable.

“Financial decision-making is very challenging cognitively,” said Jason Karlawish, a specialist in geriatrics and memory care at the University of Pennsylvania’s Penn Memory Center. “If you have even mild cognitive impairment, you can make mistakes with finances, even though you’re otherwise doing generally OK in your daily life.”

Some mistakes are irreversible. Despite Reynolds’ best efforts on behalf of her mother, the bank foreclosed on the family home in the fall of 2018.

Property records show that Lewis-Thorpe and her husband bought the two-bedroom Cape Cod for $20,000 in 1966. Theirs was one of the first Black families in their New Haven neighborhood. Lewis-Thorpe had planned to pass this piece of generational wealth on to her daughters.

Instead, U.S. Bank now owns the property. A 2021 tax assessment lists its value as $203,900.

Financial Protections Slow to Come

Though she can’t prove it, Reynolds suspects that someone had been financially exploiting her mom. At the same time, she feels guilty for what happened to Lewis-Thorpe, who now lives with her: “There’s always that part of me that’s going to say, ‘At what point did it turn, where I could have had a different outcome?'”

Karlawish often sees patients who are navigating financial disasters. What he doesn’t see are changes in banking practices or regulations that would mitigate the risks that come with aging and dementia.

“A thoughtful country would begin to say we’ve got to come up with the regulatory structures and business models that can work for all,” he said, “not just for the 30-year-old.”

But the risk-averse financial industry is hesitant to act — partly out of fear of getting sued by clients.

2018’s Senior Safe Act , the most recent major federal legislation to address elder wealth management, attempts to address this reticence. It gives immunity to financial institutions in civil and administrative proceedings stemming from employees reporting possible exploitation of a senior — provided the bank or investment firm has trained its staff to identify exploitative activity.

It’s a lackluster law, said Naomi Karp, an expert on aging and elder finances who spent eight years as a senior analyst at the Consumer Financial Protection Bureau’s Office for Older Americans. That’s because the act makes training staff optional, and it lacks government oversight. “There’s no federal agency that’s charged with covering it or setting standards for what that training has to look like,” Karp said. “There’s nothing in the statute about that.”

One corner of the financial industry that has made modest progress is the brokerage sector, which concerns the buying and selling of securities, such as stocks and bonds. Since 2018, the Financial Industry Regulatory Authority — a nongovernmental organization that writes and enforces rules for brokerage firms — has required agents to make a reasonable effort to get clients to name a “trusted contact.”

A trusted contact is similar to the emergency contact health care providers request. They’re notified by a financial institution of concerning activity on a client’s account, then receive a basic explanation of the situation. Ron Long, a former head of Aging Client Services at Wells Fargo, gave the hypothetical of someone whose banking activity suddenly shows regular, unusual transfers to someone in Belarus. A trusted emergency contact could then be notified of that concerning activity.

But the trusted contact has no authority. The hope is that, once notified, the named relative or friend will talk to the account holder and prevent further harm. It’s a start, but a small one. The low-stakes effort is limited to the brokerage side of operations at Wells Fargo and most other large institutions. The same protection is not extended to clients’ credit card, checking, or savings accounts.

Financial Industry Reluctant to Help

When she was at the Consumer Financial Protection Bureau, Karp and her colleagues put out a set of recommendations for companies to better protect the wealth of seniors. The 2016 report included proposals on employee training and changes to fraud detection systems to better detect warning signs, such as atypical ATM use and the addition of a new owner’s name to an existing checking account. “We would have meetings repeatedly with some of the largest banks, and they gave a lot of lip service to these issues,” Karp said. “Change is very, very slow.”

Karp has seen some smaller community banks and credit unions take proactive steps to protect older customers — such as instituting comprehensive staff training and improvements to fraud detection software. But there’s a hesitancy throughout the industry to act more decisively, which seems to stem in part from fears about liability, she said. Banks are concerned they might get sued — or at least lose business — if they intervene when no financial abuse has occurred, or a customer’s transactions were benign.

Policy solutions that address financial vulnerability also present logistical challenges. Expanding something as straightforward as use of trusted contacts isn’t like flipping a light switch, said Long, the former Wells Fargo executive: “You have to solve all the technology issues: Where do you house it? How do you house it? How do you engage the customer to even consider it?”

Still, a trusted contact might have alerted Reynolds much sooner that her mom was developing dementia and needed help.

“I fully believe that they noticed signs,” Reynolds said of her mother’s bank. “There are many withdrawals that came out of her account where we can’t account for the money. … Like, I can see the withdrawals. I can see the bills not getting paid. So where did the money go?”

Sarah Boden (@Sarah_Boden) is a WESA reporter.

#dementia

On deep background

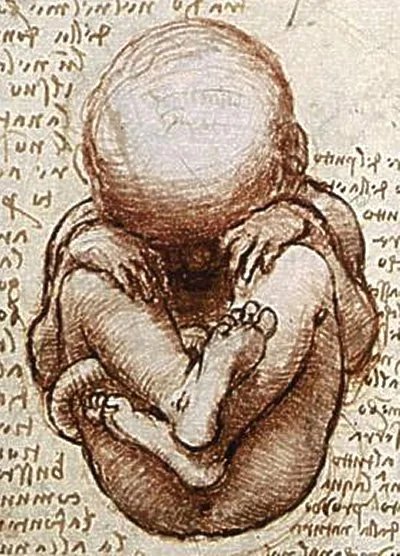

“In the Beginning: My Cultural Heritage” (monoprint and chine colle), by Lowell, Mass.-based artist Jean Winslow in the group show “Expressions of Culture and Identity,’’ at the Brush Art Gallery and Studios, Lowell, through July 30.

The gallery says the show features the work of 23 artists from Massachusetts and New Hampshire who were invited to "explore their culture or personal identity through the visual arts." The theme aligns with a soon-to-be installed exhibit by the Lowell National Historical Park.

#Jean Winslow #Brush Art Gallery

‘Light, color and shadow'

“Crush & Pull with Hands & Penlights” (Polaroid color prints), by Hartford-based photographer Ellen Carey, in her show “Struck by Light,’’ at the New Britain (Conn.) Museum of American Art, July 20 to Jan. 28

The museum says:

“Since the early 1990s, artist Ellen Carey (b. 1952) has created experimental and abstract works that defy photographic conventions. Struck by Light represents the largest survey of Carey’s innovative photo-objects and lens-based artworks. Spanning 30 years of her prolific career, the exhibition includes examples of her Photography Degree Zero (1996–2023) practice of Polaroid 20 X 24 lens-based images—including Pulls and Rollbacks—as well as her Struck by Light (1992–2023) series of camera-less photograms—Dings and Shadows—inspired by the earliest examples of paper photography. Collectively, the works trace Carey’s enormous contributions to the field of photography through her pioneering explorations of light, color and shadow, and are drawn from the collections of the New Britain Museum of American Art and the artist.’’

Polaroid Land Camera Model 95, the first commercially available instant camera. It went on the market in 1948. The “Land’’ for Edwin Land, inventor of the camera and the founder of Polaroid Corp., in Cambridge, Mass.

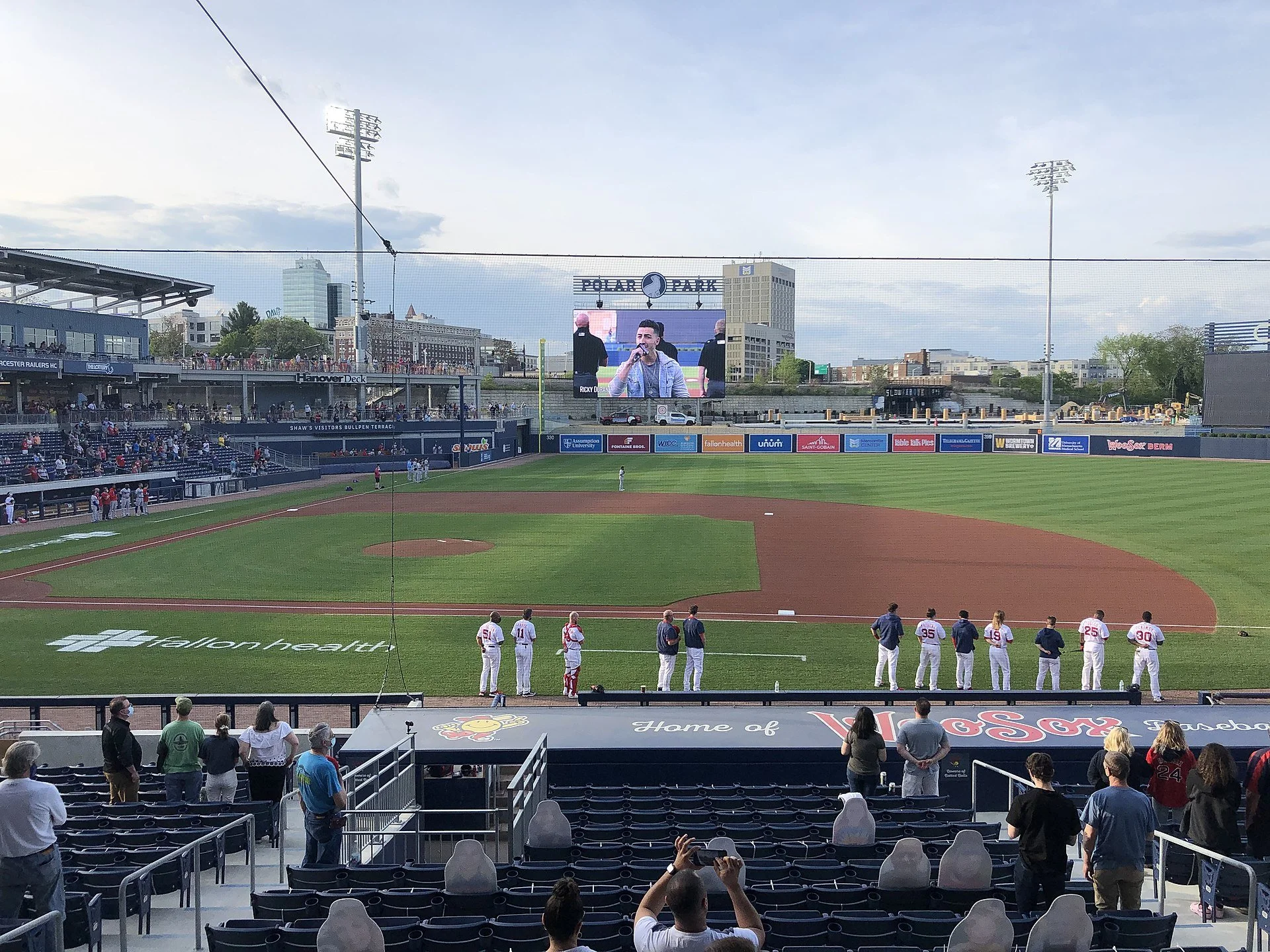

WooSox and summer, etc.

Polar Park, in Worcester

— Photo by MoVaughn123

Adapted from Robert Whitcomb’s “Digital Diary,’’ in GoLocal24.com

On June 11, I drove from Providence to Worcester on Route 146, through old mill towns, to watch the Worcester Red Sox play the Rochester Red Wings at Polar Park. The WooSox won, 5-2, and it was a nice day, with only a little Canadian smoke.

The ballfield is in a gritty and depressing part of the old industrial city, though there’s been some new building in the past couple of years. But I find that looking a few blocks over to the bizarre Union (train) Station’s twin towers, which makes the 1911 structure look like something put up during the Raj, in India, cheers me up, as do the trains running right next to the stadium.

(Don’t feel you have to use the big parking garage next to Polar Park. There’s cheaper and easier surface parking a couple of blocks away.)

The main reason I went to Worcester was to see old friends, who happen to be pals of the WooSox owners. Because of this connection, we watched the game in luxury from a suite with a lounge-like inside area and a porch from which we had a superb view of the field and the stands, though one of my hosts complained that watching a game from a fancy suite at ground level, as was the case with the Pawtucket Red Sox at McCoy Stadium, is more fun. We spent most of our time yakking while sporadically glancing at the action on the field, with cheering the main signal to pay attention.

New professional baseball playing rules, by the way, have blessedly speeded up that action.

There were a little under 9,000 people there -- close to capacity. This is only the stadium’s third year in operation and so probably more than a few in the stands were there out of curiosity to see the glitzy facility. Of course, many baseball fans are still unhappy that this Boston Red Sox affiliate bailed out of Pawtucket. I did see some Rhode Island license plates at Polar Park.

Some economists who are experts in the public financing of such stadiums say that Polar Park will be a long-term drain on the city. Worcester issued $146 million in bonds to build the stadium and owns it. It will take some years to know what the fiscal impact will probably be. The next recession with high unemployment will provide a test; buying a game ticket is, after all, very discretionary. Meanwhile, it has to be said that the WooSox is a very well-run organization.

How much money do WooSox fans from out of town spend in Worcester’s restaurants, etc., outside of Polar Park? Not much, I’d guess. And I doubt that many take in such impressive local cultural venues as the Worcester Art Museum.

Watching baseball, between gossiping with friends and meeting some of their pals for the first time while consuming the likes of lobster rolls or hot dogs (not the latter anymore for me; I avoid eating fellow mammals), popcorn and beer and other goodies is a languid summer pleasure in New England.

As are walking on a beach or along a Vermont stream; letting ice cream and Popsicles drip on your hands; going fishing; eating such vacation artery blockers as fried clams; climbing mountains; sitting on a park bench watching the birds in between desultory looks at a book, and going to country fairs and amusement parks (where you can watch the kids throw up after eating too much candy and then being spun around on a ride).

Summer has certainly changed in our corner of the world in the past five or six decades. One change is the vast expansion of air conditioning. Very few New Englanders had A/C in their homes before around 1970. Movie theaters, restaurants and big stores used to draw many customers simply because they offered cool air.

Summers have generally been getting hotter and longer, and so air conditioning has become increasingly attractive. The tricky thing is that generating the electricity to run the A/C units usually involves burning more fossil fuel, which, in turn, heats up the atmosphere more. Oh, well.

I suspect that home A/C has tended to discourage many people from spending as much time outdoors in the summer as they might have half a century ago – an unhappy change, exacerbated by computer-screen addiction. This probably has played a role in the obesity epidemic. Anyway, we all need more natural light (with sun block on our skin) and exercise. And breezy porches are soothing.

Other notable changes include the building of superhighways to places with great summer allure, most notably in New England -- Cape Cod. This has led to rampant overbuilding there and the erosion of some of the qualities that made The Cape, etc., so beautiful. (I remember the two-way country road with summer farmstands and a piney aroma that led us from Cohasset, Mass., to my grandparents’ house on the Cape in the ‘50s.) And while many folks used to lie for hours in the soporific sunshine, most of us are now aware that we were setting ourselves up for skin cancer.

One improvement is that more people are taking advantage of the fact that summer weather doesn’t end with Labor Day, and can in some years extend into October.

My drive back to Providence from Worcester was thrilling because fewer and fewer drivers these days signal before cutting across lanes. This is particularly menacing in the tangled spaghetti and confusing signage of Worcester’s roads. One guy in an SUV nearly got a bunch of us killed as he swerved across two lanes to get on an exit ramp he belatedly noticed. The best way in and out of Worcester is by helicopter.

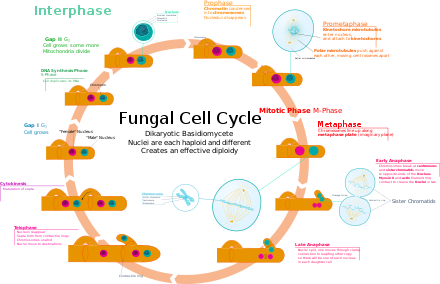

Fungi festival

Fungus vs. tree stump

Text from Colleen Cronin for ecoRI News

AUKE UT NAHIGANSECK/CHARLESTOWN, R.I. — While mycologist Lawrence Millman waited for his ride to the 24th Annual Rhode Island BioBlitz from the Providence Train Station, he did something he rarely does: he used his cellphone to call the reporter who was supposed to pick him up.

Millman only bought a cellphone two years ago, but often refuses to use it and rarely gives out his phone number. He usually arranges things via email, including rides, because he doesn’t own a car and let his driver’s license lapse years ago.

For the Rhode Island Natural History Survey’s annual BioBlitz, which he comes down from his home in Cambridge, Mass., to attend annually, he wore an old T-shirt aptly screen printed with mushrooms, hiking boots, and a bit of gray scruff.

He has been coming to the event — a 24-hour scramble to survey the number of species at a particular Rhode Island site — for a decade, he thinks. It’s one of the only mycological events that he still likes attending.

“Male myco-files of a certain age are very eager to compete with each other,” Millman said.

The fungi enthusiast doesn’t like crowds and doesn’t much care for the norms and rules of life, much like the numerous but elusive organisms he likes to study.

To read the whole article, please hit this link.

Dedrick Asante-Muhammad: Conn.'s 'Baby Bonds' and promoting racial economic equality

Illustration from the posthumously published biography of Chloe Spear, showing her abduction in Africa as a child; Spear was enslaved in Massachusetts from 1761 to until 1783.

Via OherWords.org

Juneteenth celebrates the end of chattel slavery in the United States. But over 150 years later, discriminatory public policies have prevented African Americans from closing the racial wealth divide in this country they helped build.

Policy created that divide — and policy can close it.

One state is showing how to move forward in advancing racial economic equality. This year, Connecticut is launching the country’s first “Baby Bond” program.

This program will invest $3,200 for every baby born into poverty in the state. The bonds are projected to grow to between $10,000 and $24,000 in value, depending on when they’re used.

When they reach an age between 18 and 30, these Connecticut residents will be able to use that money to start a small business, get a higher education or job training, or buy a home.

That money goes to poor residents regardless of their race. But because Black and Latino residents of the state are poorer than their white counterparts, the program will significantly address the state’s racial wealth gap — even as it gives young people of every race in the state a path out of poverty.

I’ve been researching and writing about the racial wealth divide for the last 20 years. In my view, Connecticut’s Baby Bond program is the most significant step forward in public policy I’ve seen yet. It should be an example for the country.

The program builds off decades of analysis and advocacy.

In 1959, over 50 percent of African Americans lived in poverty — a figure that had fallen to less than 19 percent by 2019. That’s still more than twice the rate for non-Hispanic whites, but it’s an example of substantial economic improvement for African Americans.

How did this happen? By removing barriers to economic and social opportunities and investing in those facing poverty.

The Black freedom movement of the 1950s and 1960s pushed for important legislation like the Civil Rights Acts of 1964 and 1968. The movement also helped advance the War on Poverty and its associated programs — including SNAP, Medicaid, and the Earned Income Tax Credit, all of which dramatically decreased poverty for the entire country.

Today we see Connecticut taking the next big step forward.

The idea for Baby Bonds came out of the wealth-building movement popularized by Michael Sherraden’s 1992 book Assets and the Poor: New American Welfare Policy. The book’s theme was the need to shift from simply supplementing people’s income to helping them build real assets — to help poor people get beyond day-to-day survival.

Child Savings Accounts under the Saving for Education, Entrepreneurship, and Downpayment (SEED) Initiative were one step in that direction.

By 2017, there were 54 of these programs serving 382,000 children in 32 states and Washington, D.C. At that time, the most common initial deposit for a Children’s Saving Account was $50 — not enough to make a significant difference in reducing poverty or the racial wealth divide.

Connecticut’s Baby Bond program was inspired by a vision to address racial economic inequality first proposed in 2010 by economists William Darity and Darrick Hamilton.

Though the return of $10,000 to $24,000 for all babies born in poverty would not bridge the nearly $150,000 wealth divide between Blacks, Latinos, and whites, it would about double the median wealth of Black and Latino households in the state.

Hopefully this is the beginning of states nationwide creating similar wealth-building programs.

It could also build momentum for the national American Opportunity Accounts Act introduced by Senator Cory Booker (D.-N.J.) and Rep. Ayanna Pressley (D,-Mass.). That law would provide a Baby Bond of $1,000 for every American child — with an annual addition of up to $2,000 for the lowest income Americans.

For generations, we’ve done little to bridge the racial wealth divide or get families out of multi-generational asset poverty. Connecticut’s Baby Bond program, which launches in July, and similar proposals across the country show that we may finally be willing to take the next step.

Dedrick Asante-Muhammad is chief of membership, policy and equity at the National Community Reinvestment Coalition and an associate fellow of the Institute for Policy Studies.

Read about Slavery in Connecticut

Where physical and visual meet

“Strange Attractor,’’ by Kathleen Kucka, in her show of the same name at Heather Gaudio Fine Art, New Canaan, Conn., through July 22. She lives and works in Falls Village, Conn., and New York City,.

The gallery says:

“Throughout her career, Kucka has pushed the boundaries of traditional painting, experimenting with unconventional techniques to create works that blur the line between two and three-dimensional art. Utilizing a variety of methods including burning or pouring paint, she creates works that focus on materiality and examines the interplay between physical and visual aspects of her chosen medium.’’

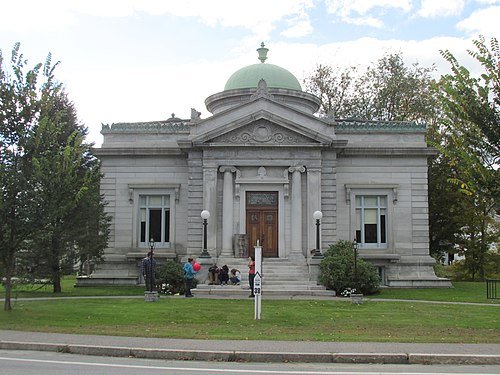

The D.M. Hunt Library in Falls Village, part of town town of Canaan in the Berkshires

Mass. city neighborhood to get geothermal heating/cooling system

Enhanced geothermal system 1: Reservoir 2: Pump house 3: Heat exchanger 4: turbine hall 5: Production well 6: Injection well 7: Hot water to district heating 8: Porous sediments 9: Observation well 10: Crystalline bedrock

“Eversource has officially begun a groundbreaking project to implement a one-of-its-kind heating system in a Framingham, Mass., neighborhood.

“This program is designed to explore whether geothermal networks can be used in combination with, or instead of, traditional energy sources like natural gas or heating oil. To test this, Eversource plans to install and operate a geothermal network in a neighborhood in Framingham, providing indoor heating and cooling to about 150 customers within the one-mile-long loop that pipes 37 buildings (32 residential, five commercial).

“‘We continue to invest in different kinds of technologies, but that’s not enough,’ said Joe Nolan, the utility’s president and chief executive officer. ‘That’s why we’re so excited to be here today around geothermal. I spend a lot of time on the road, I talk to our investors, I talk to our key decision-makers. This is one of the most exciting opportunities for me to ship now what is going on in geothermal.”’

The Common in Framingham Center

— Photo by Jerem43

#geothermal

#Eversource

#Framingham

'Sound's visual memory'

“Nightsong” (oil on canvas), by Boston-based artist Aaron Norfolk, in his show “Audio Visio,’’ at the Art Complex Museum, Duxbury, Mass., through Aug. 13

The museum says:

{Norfolk’s} “large, color-rich paintings begin with what he hears, not with what he sees. He says, ‘Sight and sound run parallel in our perception, and these works do not intend to confound the two. Rather, the interest is for the viewer to switch back and forth across subjectivity, allowing sound its visual memory. As a word becomes a sound’s visual placeholder, so these paintings become their portrait.’’’

'Though his pass is middle-class'

James Michael Curley in 1949, in his final term as Boston mayor

Principal streets of the Back Bay, an affluent part of Boston

“I enjoy a tender pass

By the boss of Boston, Mass.,

Though his pass is middle-class

And not Back Bay

But I'm always true to you, darlin', in my fashion

Yes, I'm always true to you, darlin', in my way.’’

— From the song “Always True to You in My Fashion,’’ by Cole Porter, in the 1948 musical Kiss Me, Kate. The “boss” referred to was apparently the colorful and corrupt Mayor James Michael Curley (1874-1958).

Chris Powell: Don’t need to evoke sex to make students behave; deconstructing two big misnomers

The rainbow flag has become a symbol of LGBT culture and is flown a lot during “Pride Month’’. But why be “proud’’ of something believed to be mostly innate?

— Photo by Benson Kua

MANCHESTER, Conn.

Schools in Connecticut aren't doing as well as they once did teaching reading, math and the other academic basics, but they seem to be finding more time to address sexual subjects. The latest examples come from an elementary school in Granby and a middle school in Southington, where “Pride Month’’ videos were shown to students. News reports said the video shown in Granby involved transgenderism, and after it was shown, feminine-hygiene products were distributed to the boys as well as the girls in the audience.

The intent of these exercises is to discourage disparagement and bullying of students who are different or are suspected of being so. But the sexual aspects of these exercises raise questions of propagandizing, age-appropriateness and the pre-emption of parents.

That's why the exercises may be both too explicit and too narrow. For people are different in many ways apart from sexual orientation and gender identity -- different in race, ethnicity, religion, politics, and so forth. So why the emphasis lately on sexual orientation and gender, if not for propagandizing? Where are the tolerance-supporting videos about the many other differences?

Kids can be both cruel and cowardly. They are easily pressured into joining campaigns of bullying. But no lecture on sexual preferences or gender dysphoria is necessary to dissuade them. Instead kids can be instructed simply to behave decently toward their classmates -- to be polite and kind in school, to recognize that people have the right to their personal lives, to keep to themselves their judgments of those personal lives, and to understand that they will be disciplined sternly when they violate these standards.

Discipline long has been lacking in public education in Connecticut, even for the most disruptive students. Parents continue to complain that their children are bullied by classmates and that school administrators do little about it. If disparagement and bullying of students now are also chronic in regard to sexual orientation and gender identity, schools need more discipline, not more videos, propaganda, or distribution of feminine hygiene products to boys as well as girls.

xxx

Besides, Pride Month itself is a misnomer if, as Connecticut has presumed for more than 50 years, sexual orientation is largely innate, a matter of heredity and environment that, while nobody's business but one's own, is nothing to be proud about either, insofar as no one does anything to earn it.

Sometimes courage may be required for being candid about one's sexual orientation or gender identity, but that's a different issue. What should be celebrated here is not sexual or gender identity but the personal freedom the United States affords, its declaration "that all men are created equal, that they are endowed by their Creator with certain unalienable rights, that among these are life, liberty, and the pursuit of happiness."

There is already a national holiday recognizing that. It is coming up in three weeks, though schools seem to be teaching less about it than about sexual orientation and gender identity.

xxx

Another misnomer is about to be celebrated: June 19, or Juneteenth, which is erroneously portrayed as marking the end of slavery in the United States toward the end of the Civil War, in 1865. In fact the date notes only the arrival of Union troops in Galveston, Texas, whereupon, in accordance with President Lincoln's Emancipation Proclamation 2½ years earlier, Gen. Gordon Granger declared the freedom of all slaves in the rebellious state.

But slavery continued in the country for another six months after Juneteenth -- remaining legal in New Jersey, Kentucky and Delaware -- until ratification of the 13th Amendment, on Dec. 6, 1865.

So if a special holiday is needed to mark the end of slavery, the proper date is Dec. 6.

It might be called Freedom Day and used to teach about slavery and the long and heroic political, religious, and military struggles to get rid of it. Such a holiday might teach about inequalities that remain today and can be traced back to slavery.

Instead the one thing people will learn from Juneteenth is false.

Chris Powell has written about Connecticut government and politics for many years. (CPowell@cox.net). He’s a former managing editor of the (Manchester) Journal Inquirer

‘On a big expedition’

Shedd-Porter Memorial Library, in Alstead, N.H., was designed in the Beaux-Arts style by Boston architects William H. McLean and Albert H. Wright. It was built in 1910 as a gift from John Graves Shedd and Mary Roenna Porter in memory of their parents.

“The New England Thinkers

”Don't rush my sitting under the finch book tree. It has been dark for ten days and like two eyes feed one brain, we go driving. We are on an expedition to see the big numbers and wreckage of the floods.’’

— From the poem “The Continent Behind the College,’’ by Lesle Lewis

Ms. Lewis teaches at Landmark College (the college referred to), in Putney, Vt., and lives across the Connecticut River, in Alstead, N.H.

Without the aroma

“Graphic Marsh” (oil on gesso board), by Sue Dragoo Lembo, at Alpers Fine Art, Rockport, Mass.

The Great Marsh in Plum Island, Newbury, Rowley and Ipswich, Mass.

— Photo by Don Searls