Don Pesci: 'Tax relief' and 'tax cuts' on shifting sand

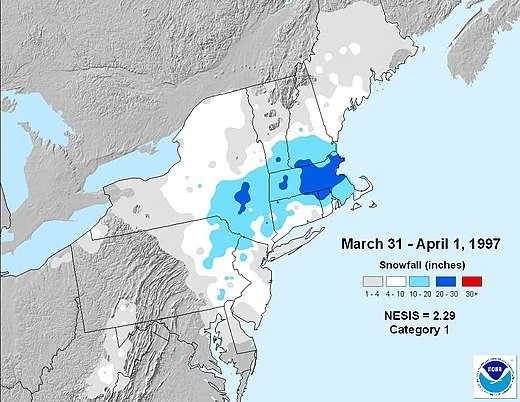

Egyptian peasants seized for non-payment of taxes several thousand years ago.

VERNON, Conn.

“The future ain’t what it used to be”

– Yogi Berra

The headline in a CTMirror story, “CT budget deal includes $600M in tax cuts, extends gas tax holiday”, includes a telling subtitle: “But more than half the tax relief is guaranteed for just one year.

There’s always a “but” in good journalism raining on someone’s parade.

The thrust of the story raises an interesting question: In what sense is “tax relief” a “tax cut”?

Many of the “tax cuts” referenced in this and other stories in Connecticut’s media are either temporary tax cuts or tax credits.

A temporary tax cut is only a “tax cut” until it elapses, after which it becomes once again a tax increase. And a “tax credit” is not, properly speaking, a tax cut. A tax, almost always permanent, moves money from a taxpayer’s budget to a state or federal treasury. A “tax cut” terminates the movement and leaves disposable assets in the account of the taxpayer.

A tax credit retains in public treasuries money moved from private to public accounts and surrenders a small part of the tax money collected to favored taxpayers.

From the point of view of the tax collector -- the state or federal government -- the beauty of a tax credit lies in the generally false appearance that those extending the credit are surrendering to preferred groups money that has been earned by state or federal government.

In moments of extreme clarity, everyone knows that a state government does not “earn” money of its own, as do private enterprises by producing and selling goods and services. States are tax collectors only, and the money they apportion belongs to tax payers who, through their own labor, earned their assets. Naturally, those surrendering money to state or federal government would like to believe political claims that the money collected would be used by government to increase the “public good.”

That is why the headline writer for CTMirror felt compelled to add to the story that clearly identifies what state Democrats and some media adepts consistently call “tax cuts” a subtitle that identifies the so called “tax cuts” as “tax relief.” A true tax cut eschews collection and leaves assets to be disposed of by a creative, enterprising and profit-seeking private marketplace. A tax credit reduces all three elements – minus a small bit of tax relief, usually temporary, apportioned for political purposes to groups favored by a reigning political party.

During election times, epistemological confusion – calling a tax credit or temporary suspension of a tax a “tax cut” – is everywhere, because give-backs and tax relief, however temporary, purchase votes, and the party in power is always interested in purchasing votes so that they may retain office and eventually raise the level of taxation to purchase vote and retain political power.

Connecticut’s temporary tax cuts and credits are built on shifting sand.

“The tax cuts,” a Hartford paper noted, “are possible because of a quickly growing state budget surplus and more than $2 billion in federal stimulus funds over 2 years that have helped fund numerous programs across the state.” The state’s budget surplus – i.e., the amount of money the state has overtaxed its citizens – is projected to reach $4 billion. And the federal stimulus funds aggravate inflation and possibly a pending recession. It takes Connecticut about 10 years to recover from a national recession.

It gets worse: The money that will finance more excessive spending is finite, and temporary, but the spending it purchases is mostly permanent and more costly than Connecticut taxpayers can afford in an era of mounting inflation, which reduces the purchasing power of the dollar, and a diminishing population.

The Yankee Institute devoted a carefully researched paper, CT’s Growing Problem: Population Trends in the Constitution State, to Connecticut’s dangerous population issues over the past few decades. The 2020 U.S. Census shows Connecticut as a negative outlier: “In a decade when the nation’s population grew by 7.4 percent, Connecticut’s population grew barely at all – less than 1 percentage point. Only 3 states ranked below Connecticut: West Virginia, Illinois and Mississippi, all of which lost population.”

If the future in Connecticut “ain’t what it used to be,” perhaps true reformers who wish to advance the public good should focus on the palpable effects ruinous policy has on the future. It is at least worth discussing whether state policy makers spend money like drunken sailors because, so long as the state can pass on to future generations the disastrous, but quite predictable consequences of hedonistic spending, politicians now serving in the General Assembly needn’t worry overmuch about their own immediate job prospects.

Don Pesci is a Vernon-based columnist.

Don Pesci: Give the Ukrainians back their skies

The Black Madonna of Czestochowa

VERNON, Conn.

Just before the joy of Easter broke upon us, Austrian Chancellor Karl Nehammer met with Russian President Vladimir Putin in Moscow, far from Russian bombardments in Ukraine.

In an interviewed on NBC’s “Meet the Press,” Nehammer said that Putin thinks he is winning the war in Ukraine despite heavy military losses and the fruitless non-stop bombing of Ukrainian cities. Putin certainly has left his mark on Ukrainian cities, and will continue to do so as long as Ukraine’s military cannot close Ukrainian air space to what can only be called urban carpet bombing.

More bombing in Bucha and Mariupol, for instance, can do little more than disturb the rubble of Putin’s carefully chosen targets.

There is not a single military man in Connecticut, from private first class to general, who would not tell you that whoever controls the skies in a war also controls ground offenses, however brave and resolute the resistance.

“We have to confront him [Putin] with that, what we have seen in Ukraine,” said Nehammer.

What the entire world has seen in Ukraine are corpses. According to an Associated Press report, Nehammer “also said he confronted Putin with what he saw during a visit to the Kyiv suburb of Bucha, where more than 350 bodies have been found along with evidence of killings and torture under Russian occupation, and ‘it was not a friendly conversation.’"

A noble Ukrainian resistance to Putin’s terror regime is lost on Putin, who calculates that nobility, honor and patriotism can be sufficiently answered by more frequent remote bombing and deadly trip wire devices placed after strategic withdrawals in refrigerators, the trunks of cars and under corpses his troops have left behind in Bucha and Mariupol.

“In the Kyiv region,” the AP reported, “authorities have reported finding the bodies of more than 900 civilians, most shot dead, since Russian troops retreated two weeks ago.”

President Biden and other Democrats continue to tout the efficacy of sanctions, much appreciated by Ukrainian President Volodymyr Zelenskyy. But both presidents know that sanctions are neither offensive nor defensive weapons of a kind Ukraine needs to stop the Russian assault on Mariupol, for weeks Putin’s terrorist playground. Should Mariupo completly fall to Russia, Putin will be able to construct a land bridge from Russia to Crimea, surrendered to Russia during the administration of President Obama and Vice President Biden with hardly a whimper.

Even U.S. Sen. Dick Blumenthal, the Connecticut Democrat, believes that Ukraine may not be able to survive Putin’s latest attentions unless the United States is willing to supply the country with air power that will allow Ukraine to recover its skies from the Russians.

Newly returned from Poland, Blumenthal recently told New Britain Polish-American and Ukrainian American leaders, “If I have one plea to the president of the United States, it is provide more air defense to the people and the brave freedom fighters of Ukraine. The anguish and grief in their eyes is heartbreaking and harrowing. It was one of the most moving moments of my life to talk with them -- we spent the whole day at the border crossing where just hours before the Russians bombed the town just 12 miles away.”

There are many Ukrainian churches in Connecticut. Two weeks before Easter, my wife, Andree, and I visited a Ukrainian church in Hartford and after Mass had a brief talk with a priest who hails from Lviv, a city in western Ukraine that has not yet been entirely leveled by Putin, whom the priest likely regards, somewhat charitably, as the Judas of Christian Orthodoxy.

Diplomacy is fine, but it has not saved a single Ukrainian life, we were given to understand. Ukrainians are hopeful believers in the promises of God.

We spent Easter – Holy Saturday actually – in a church in Vernon my wife sometimes calls “the Polish church.” There the choir seems to call us from Heaven itself, and a representation of Poland's most well-known icon, the Black Madonna of Czestochowa, hangs just to the left of Christ on the cross.

When Mary, here portrayed sorrowfully near the cross, presented Jesus in the temple, she was told that, however joyful the moment, a sword one day would pierce her heart.

Simon clasped Jesus in his arms and, recognizing his divinity, said “Sovereign Lord, as you have promised, you may now dismiss your servant in peace. For my eyes have seen your salvation, which you have prepared in the sight of all nations a light for revelation to the Gentiles, and the glory of your people Israel.”

And then Simon, turning to Mary, said, “This child is destined to cause the falling and rising of many in Israel, and to be a sign that will be spoken against, so that the thoughts of many hearts will be revealed. And a sword will pierce your own soul too.”

There are forebodings of despair everywhere in the testimony of the Apostles and the Fathers of the Christian Church. Over and against them all, my Ukrainian priest reminded us, stands the towering promises of God that we Christians celebrate at Easter.

Christ meets Mary Magdalene at the empty tomb and asks, “Woman, why are you weeping? Whom are you seeking?”

Supposing Him to be the gardener, she pleads, “Sir, if you have carried Him away, tell me where you have laid Him, and I will take Him away.”

Jesus said to her, “Mary!”

She then recognizes Him.

“Rabboni!”

“Do not cling to Me, for I have not yet ascended to My Father; but go to My brethren and say to them, ‘I am ascending to My Father and your Father, and to My God and your God.’ Mary Magdalene came and told the disciples that she had seen the Lord, and that He had spoken these things to her.”

Later, the first word the risen Christ brings to his disciples, cowering as usual in fear, is “Peace be with you.”

But His is not peace “as the world knows peace. These things I have spoken unto you, that in me ye might have peace. In the world ye shall have tribulation. But be of good cheer -- I have overcome the world.”

A sword cleaves my priest’s heart. In Ukraine, the streets flow with blood and tears. My Ukrainians, the priest tells us, forget nothing, remember everything, and live in hope.

Don Pesci is a Vernon-based columnist.

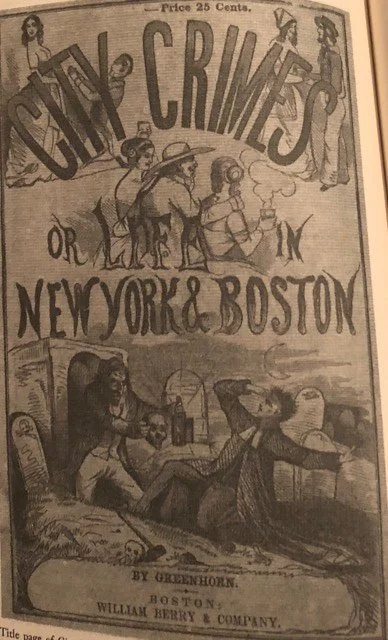

‘Panting like spaniels’

“Climbing the stairway gray with urban midnight,

Cheerful, venial, ruminating pleasure,

Darkness takes me, an arm around my throat and

Give me your wallet.

Fearing cowardice more than other terrors,

Angry I wrestle with my unseen partner,

Caught in a ritual not of our own making

panting like spaniels….”

— From “Effort at Speech,’’ by William Meredith (1919-2007), U.S. poet laureate in 1978-1980. He taught at Connecticut College, in New London, and had a farm on the Thames River in nearby Uncasville, an old mill village in the town of Montville. He became a very able arborist.

The admissions building at Connecticut College, founded in 1911 as "Connecticut College for Women" in response to Wesleyan University, in nearby Middletown, closing its doors to women in 1909; it shortened its name to "Connecticut College" in 1969, when it began admitting men.

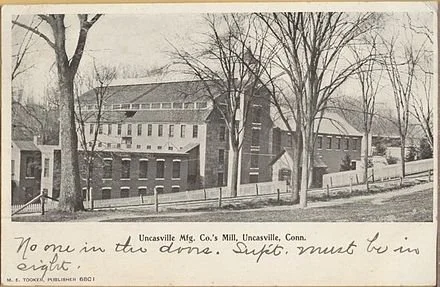

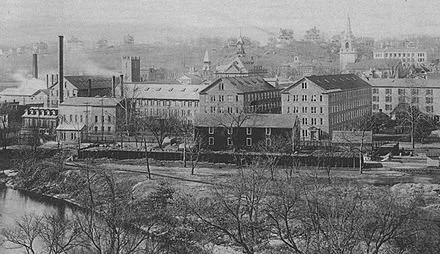

Uncasvillle Mill in 1906, in its industrial heyday

‘136 weathers in 24 hours’

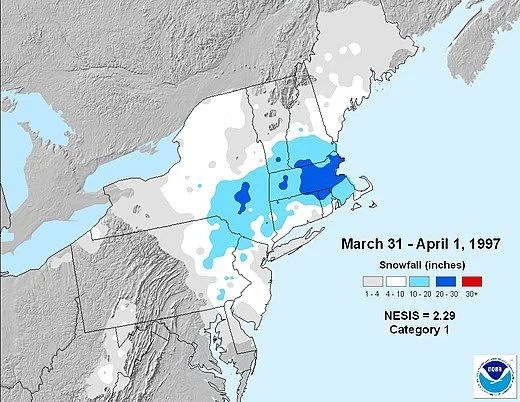

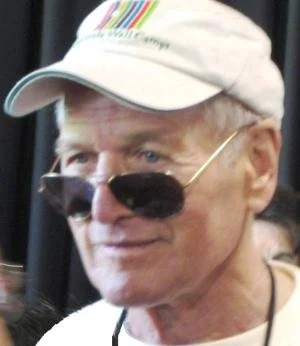

The “April Fool’s Snowstorm’’ of 1997

“There is a sumptuous variety about the New England weather that compels the stranger's admiration — and regret. The weather is always doing something there; always attending strictly to business; always getting up new designs and trying them on people to see how they will go. But it gets through more business in spring than in any other season. In the spring I have counted one hundred and thirty-six different kinds of weather inside of twenty-four hours.’’

— Mark Twain (1835-1910), in his “New England Weather” speech to the New England Society on Dec. 22, 1876. The native of Missouri spent much of his adult life at his grand house in Hartford and spent his last two years at his house in Redding, Conn.

Don Pesci: Conn.’s temporary gasoline-tax cut and trying to repeal economic common sense

Major roads of Connecticut

VERNON, Conn.

The default position of Connecticut’s majority Democrats on the matter of getting and spending has not changed within the past three decades: Tax cuts, infrequently imposed, should be temporary and bravely endured, while tax increases, deployed for the most part to satisfy imperious state-employee-union demands, should be permanent.

The recent temporary suspension of Connecticut’s 25-cent-a-gallon excise gasoline tax conforms to the default position of Democrats who have controlled Connecticut’s General Assembly for the last 30 years: The tax is to be suspended – operative word – “temporarily” from April to July 1.

Connecticut Democrats, it should seem obvious, are reading from a national Democratic script.

The increase in the price of gasoline, they say, is due chiefly to the Russian war of aggression in Ukraine and the greedy oil barons.

The debate in the General Assembly on reducing Connecticut’s gasoline tax centered upon whether the reduction should be temporary or permanent.

“Rep. Sean Scanlon, a Guilford Democrat who co-chairs the tax-writing committee,” one newspaper noted, “said many constituents have been hurting from the rising prices at the pump, which was recently an average of $4.32 a gallon.

“Our constituents did not start a war in Ukraine,’' Scanlon argued. “Our constituents did not contribute to the global supply chain. ... This is a great first step that we can make to give them some affordability, some relief. ... At least we’re doing something.”

The newspaper correctly noted, “The tax cuts are possible partly because the state has large budget surpluses in two separate funds due to increased federal stimulus money and capital gains taxes from Wall Street increases, paid largely by millionaires and billionaires in Fairfield County.”

In the state Senate chamber, also dominated by Democrats, Will Haskell, of Westport, rose to the occasion. Haskell argued that the gasoline-tax cut should not be permanent because providing permanent relief would deliver a “debilitating blow’' to the state’s plans to spend millions of dollars to fix roads and bridges. The paper quoted Haskell: “Gas prices are high, but not because of taxes. It’s because of [Russian dictator Vladimir] Putin.”

The federal government – which prints money, borrows money and acquires money through excessive taxation – is flush with funds now being distributed by the Biden administration to various political receptacles, some say for political purposes. In many instances, states are using the funds to offset business slowdowns caused by, some argue, imprudent decisions made by governors and federal officials that have produced a worker shortage. Common sense tells us that if you provide a living salary to workers not to work, they will not work.

High business taxes, an increase in the supply of money flowing from private pockets to the public purse, and labor shortages have produced too few goods, resulting in inflation – too many dollars chasing too few goods.

The high price of goods and services may also be attributed to a continuing effort by progressives in the United States to repeal a central law of a free-market economy, the law of supply and demand, which holds that when demand is a constant and supply is diminished, prices on all goods and services rise. The rise in prices has less to do with the greed of billionaire CEOs than a Darwinian survival-of-the fittest-impulse in over-regulated markets centrally directed by Washington politicians. Large business can survive a large regulator drag on profits. Higher taxes and an increasing regulatory burden swamp smaller businesses and, of course, make it much easier for the larger fish to swallow the minnows.

The empty shelves in Russian stores during the good old days of the Soviet Union were attributed by underpaid “workers of the world” in Russia to central planning. In the so-called “captive nations,” the necklace of states now threatened militarily by Vladimir Putin, workers used to joke among each other, “We pretend to work, and they pretend to pay us.”

The Democratic Party program runs against the grain of good sense. Every worker in the United States knows that personal debt should be discharged by responsible debt holders willing to cut spending and pay down the debt.

Temporary reductions in taxes are insufficient to pay down a debt in Connecticut that has swelled over the years to about $57 billion. And given past performance, no one in the state can be certain that increased taxes will be put to such purposes by an administrative apparatus, growing daily, that had in the past raided various Connecticut lockboxes to pay for current expenses.

The solution to Connecticut’s most pressing economic problems is disarmingly simple: Enrich the state’s creative middle class by cutting taxes and regulations, pay down debt, and work hard to dissolve the entangling alliances between a tax-thirsty government and an even more tax-thirsty conglomeration of various state employee unions.

Don Pesci is a Vernon-based columnist.

The Mystic River Bascule Bridge, built in 1922, carries US 1 over the Mystic River in Connecticut. The famous span connects Groton with the Stonington.

‘Shapes of mind’

“The Layers of Clouds in Night,’’ by Hyun Jung Ahn, in her show “Rendezvous,’’ at Heather Gaudio Fine Art, New Canaan, Conn., April 2-May 7.

The gallery says:

“Born and raised in South Korea, Ahn is a multidisciplinary artist who moved to New York City in 2015 in pursuit of her second M.F.A. Her work investigates abstraction through enigmatic forms she terms ‘shapes of mind’. The cultural differences and language barriers she experienced when she moved to the United States forced Ahn to ‘quiet her mind’, as she states. Her work evolved from the figurative and representational to a reduced abstraction that economized and purified her expression. The result was a new visual language that became more hermetic and enigmatic in color and form. Although today she is mostly Brooklyn-based, she continues to straddle both cultures by maintaining a studio and teaching position in Seoul.’’

Waveny mansion in Waveny Park, in New Canaan.

Chris Powell: Judge Jackson flunks the ‘what is a woman’ test; school daze; United Robots’ mystery building

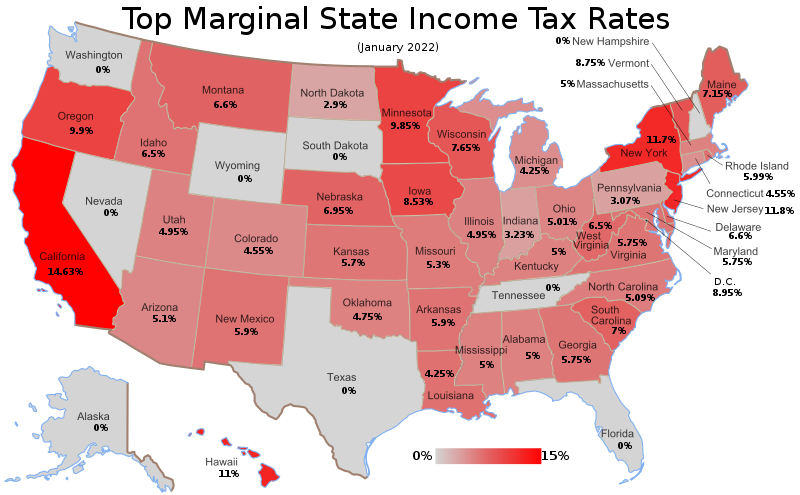

Graphic by F l a n k e r

MANCHESTER, Conn.

President Biden nominated Judge Ketanji Brown Jackson to the Supreme Court to fulfill a campaign promise to give the court its first Black woman. But this week Jackson told the Senate Judiciary Committee that she can't define "woman" because "I'm not a biologist."

So how could the president have been so sure as to what constitutes a woman? He's no biologist either.

And how could the Democratic senators supporting Jackson, also no biologists, be so sure even as they are trying to push her through the confirmation process before her judicial and political philosophies are explored too much?

When the hearing on Jackson's nomination began, "woman" was in the dictionary, and had been for a long time.

But Jackson's evasion on the woman question was a strong hint that if she makes it to the court she will assist the extreme political left in promoting transgenderism and erasing any recognition of gender differences, particularly in regard to women in sports.

Of course, for many years all Supreme Court nominees have been evasive about their views on legal and political controversies. But this evasion never has been taken as far as Jackson took it this week.

The Senate should not accept such evasion. It should tell the president that if he wants to nominate a Black woman for the court, he should find one who at least isn't afraid to admit knowing what a woman is.

Hamden (Conn.) High School . The school’s main building was built in 1935 and is listed on the National Register of Historic Places. The lobby has murals showing scenes from Hamden's history.

— Photo by Streetsim

According to a Rasmussen poll this week, 58 percent of likely U.S. voters think that the public schools are getting worse, with only 13 percent thinking that they are improving.

Of course, the virus epidemic's interruption of schooling has damaged education terribly. But education already had been declining for years and is probably even worse than the 58 percent in the poll believe. A report in the New Haven Independent this week may not have been surprising but still should have been horrifying.

Quoting the city school system's data, the Independent reported that the performance of 45 percent of New Haven students is two grades behind where it should be and the performance of another 44 percent of students is one grade behind. Only 11 percent of New Haven students are performing at grade level.

Since most of the city's children are fatherless and impoverished, New Haven is worse in this respect than Connecticut generally, but statewide student performance should horrify as well. The last time Connecticut's high school seniors were formally tested for subject proficiency was in 2013 by the National Assessment of Educational Progress. While Connecticut's seniors performed best in the country, half still had not mastered high school English and two-thirds still had not mastered high school math.

Even so, contrary to the Rasmussen poll, most people in Connecticut seem satisfied with their public schools. At least there is no movement to improve schools academically or seriously examine student performance.

Maybe opinions about schools are like opinions about Congress, where most people think that Congress is corrupt and taking the country in the wrong direction even as most people like their own members of Congress

After all, there's some comfort in thinking that while schools are declining generally, one's local schools are still great and that, as in Lake Wobegon, all local students are above average. Such thinking relieves parents of any responsibility to take note of public education's transition from academic learning to "social and emotional learning" with a dollop of political indoctrination -- schooling without the inconvenience of proficiency-test scores.

xxx

Connecticut's Hearst newspapers this week published a remarkable news item produced by an outfit called United Robots, whose computer programs process raw data and put it into prose.

This particular item, drawn from property records, said a "spacious and historic house" in Bridgeport with three stories, 3,700 square feet, seven bedrooms, three bathrooms, and a detached garage had been sold for a mere $2,000. A photograph showed the house looks intact and secure.

But the "robots" didn't explain the low price, so incongruous amid Connecticut's housing shortage. Bridgeport is a troubled city but residential property there is not worthless. There must be a reason for the giveaway price of that house but the "robots" apparently lack the curiosity of a live reporter.

Chris Powell is a columnist for the Journal Inquirer, in Manchester.

‘Feelings that art can restore’

“Multiple Phantasms” (encaustic wax, Fiber Clay, slinky), by Cheshire, Conn.-based artist Ruth Sack.

She says:

“Phantasmagoria: A bizarre or fantastic combination, collection, or assemblage.

“I slid down the tongue of a giant monster and emerged exultant. The monster was a play structure by Niki de Sainte Phalle called ‘Golem.’ I have since created my own whimsical artworks in order to spark that same thrill. The sculptures in this exhibit are inspired by Saint Phalle in pursuit of that excitement. I am as thrilled moving through a gigantic sculpture as I am when making a piece of art that delights me. These are the sort of feelings that have been quashed by the pandemic. These are the sort of feelings that art can restore.

“These works are part of a series called ‘Phantasmagoria.’ They have evolved from earlier coiled sculptures that evoked letterforms and primitive symbols. With the addition of organic shapes and detailed patterns, these pieces started to resemble lifelike characters. Each sculpture appears to be transitioning from an abstract form into an animated figure. This metamorphosis can summon thoughts of mythology and contemporary tales.’’

In Cheshire, from left to right: Cheshire Town Hall, Congregational Church, Historical Society, and Civil War memorial. The town also has a large bomb shelter under an AT&T tower. Given Russian mass murderer Putin’s tendencies, it may come in handy.

Roaring Brook Falls in Cheshire.

Chris Powell: Making somone else pay for what you get

Egyptian peasants seized for non-payment of taxes at the time of the pharaohs.

From The Outline of History (1920), by H.G. Wells

MANCHESTER, Conn.

Liberal Democratic members of the Connecticut General Assembly again are pursuing what they call fairness in taxation, their euphemism for state government's raising and spending a lot more money. Gov. Ned Lamont, a Democrat, opposes increasing taxes while state government has a lot of emergency federal cash on hand. But the governor may be glad of the tax- fairness clamor, since it emphasizes his moderation in his party as he seeks re-election in a campaign that increasingly seems competitive.

According to the tax-fairness clamor, the poorest people in Connecticut pay a bigger percentage of their income in taxes than the state's rich do. But then the poor also receive more in direct government benefits than nearly everyone else and cause far more problems than most other people. Poverty hasn't yet become a civic virtue, even if few people remember Teddy Roosevelt's contention that the first duty of the citizen is to pull his own weight.

That so many able-bodied people in Connecticut can't pull their own weight has not prompted the tribunes of liberalism to ask why, though some questions are elementary. How does the welfare system's depriving so many children of fathers help them grow up able to pull their own weight? How does social promotion in the schools incentivize them to learn what they need to pull their own weight?

Instead these government policies proletarianize children to grow up to be dependent on government.

The country's tax structure is set up to make state and municipal taxation less progressive -- to be much less geared to personal income. Federal income taxes are heavier than state and municipal income taxes and produce far more revenue. Since the federal income tax is so heavy, states and municipalities don't tax income as much, relying instead on sales and property taxes, which tend to be regressive.

But citizenship requires even the poor to feel some of the burden of government, and in its totality the tax system is more progressive than its seems at a glance. After all, states and municipalities receive, especially now, enormous amounts of financial aid from the federal government and the federal government finances the bulk of assistance to the poor through medical insurance, housing and food programs.

More progressive taxation on the state level is never advocated for progressivity's sake alone but always as a more tolerable mechanism for increasing government revenue and spending.

For state government easily could achieve more progressivity in taxation without raising taxes on anyone and without spending more -- just by reallocating appropriations.

For example, state government could end the priority given to government employee raises and benefits and use the savings to reduce the sales tax, a regressive tax. State government could use the savings to assume the full cost of “special education” in municipal schools, thereby enabling reduction of the municipal property tax, another regressive tax, especially damaging in the cities, where most of the poor live.

Indeed, if more progressive taxation is a matter of justice, why do Connecticut's liberal Democrats seek repeal of the $10,000 limit on the federal income tax deduction for state and municipal taxes? Nearly all the tax benefit of lifting the cap would go to wealthy people, but in high-tax states like Connecticut, many wealthy people are Democrats and major political donors.

Liberalism in Connecticut sees fairness in taxation as little more than compelling someone else to pay for what you get, with government employees taking a cut as the money is moved around.

xxx

Connecticut shouldn't be done with the issue of police accountability.

The recent legislation that appears to remove the “qualified immunity” enjoyed by police officers against damage lawsuits should be reconsidered, since no one is sure how it will be construed.

And a new legislative proposal should be enacted: to prohibit police departments from hiring officers who, after due process, have been fired for misconduct or malfeasance by other departments.

It's bad enough that Connecticut school systems trade teachers who have performed poorly or engaged in misconduct, a practice facilitated by the state law preventing disclosure of teacher evaluations.

But at least teachers don't carry guns at work.

Chris Powell is a columnist for the Journal Inquirer, in Manchester.

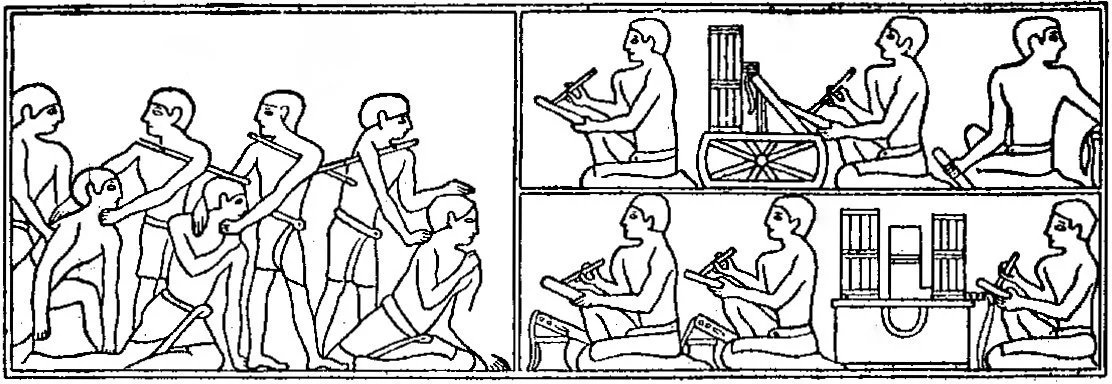

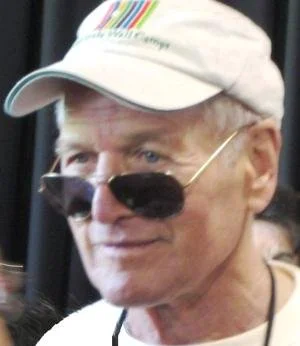

Paul Newman on character

“A man with no enemies is a man with no character.’’

— Paul Newman (1925-2008), movie star and philanthropist. He eschewed living in Southern California, instead living most of his adult life in Westport, Conn., an affluent New York suburb on Long Island Sound.

With writer A. E. Hotchner, Newman founded Newman's Own, a line of food products, in 1982. All proceeds after taxes are donated to charity.

Among other awards, Newman's Own co-sponsors the PEN/Newman's Own First Amendment Award, a $25,000 reward designed to recognize those who protect the First Amendment.

Another beneficiary of his philanthropy is the Hole in the Wall Gang Camp, a residential summer camp for seriously ill children in Ashford, Conn., which Newman co-founded in 1988. It is named after the gang in his film Butch Cassidy and the Sundance Kid (1969), and the real-life, historic Hole-in-the-Wall outlaw hangout in Wyoming. The original camp has grown to include Hole in the Wall Gang Camps in the U.S., Ireland, France and Israel.

The Westport Country Playhouse, which was heavily supported by Mr. Newman and his widow, movie star Joanne Woodward, for many years.

Hole in the Wall Gang Camp in Ashford in the off-season

Ashford in 1838

Chris Powell: Gasoline-tax pandering in Conn.

I-95 crossing the Connecticut River in Old Saybrook/Old Lyme, Conn.

— Photo by JJBers Public -

MANCHESTER, Conn.

Are things getting so bad for the Democrats that even Connecticut's senior U.S. senator, Richard Blumenthal, is worried about winning re-election this year?

That might have been construed from the senator's silly pandering last week about gasoline taxes.

Blumenthal -- for 20 years the "eternal {state attorney} general" who now, at age 76, is seeking a third six-year term in the Senate -- called for suspending the federal gas tax, which is 18 cents per gallon. Because gas prices have risen dramatically in recent months, the senator said, people need immediate relief. Meanwhile, the senator added, the federal gas tax isn't needed because its revenue is dedicated to highways and the federal government has just appropriated billions of dollars for highways.

Blumenthal's rationale raised some big questions he didn't address.

That is, where did those billions of dollars for highways come from if not from federal gas taxes?

Mostly they were just created electronically from computer keystrokes.

And if finding money for highways is that easy, why has the country bothered with the federal gas tax in the first place -- or, for that matter, with any taxes at all?

While the federal highway fund may not need any revenue, Blumenthal's colleague in Connecticut's congressional delegation, First District U.S. Rep. John B. Larson, might remind him that the Social Security Trust Fund is projected to be insolvent in another decade and might be glad to take whatever money the highway fund doesn't need.

But even if the federal gas tax is suspended as Blumenthal and other members of Congress propose, people still will be paying its equivalent. Most just won't understand how they pay, nor that they are already paying -- through the devaluation of their money, the inflation tax on their wages and savings, which is already running at about 15 percent annually once the government's deceitful skewing of the data is corrected.

This inflation is largely a matter of the imbalance between government's money creation and national and -- since the U.S. dollar is the world reserve currency -- international production. Much more money lately has been created than goods and services have been produced.

Indeed, when it comes to government appropriations there is hardly any discussion anymore of where the money is to come from. It now is widely assumed that money is infinite, even as inflation screams that production is not.

Political responsibility for surging inflation is bipartisan, but since Democrats control the presidency and Congress, they will catch the blame. Blumenthal's pose on the gas tax shows he realizes this and is planning an escape.

A big part of the production problem is entirely a Democratic responsibility -- the Biden administration's crippling of U.S. energy production in pursuit of "greener" energy even as "greener" energy isn't close to being ready to replace the oil and natural gas supplies that are being diminished.

The environmental fanaticism of the Democrats is feeding Russia's imperialism toward Ukraine and the other former Soviet satellite states in eastern Europe. Western Europe has crippled its conventional energy production even more than the United States has and long has been heavily dependent on Russian natural gas, which can be cut off if its recipients get serious with economic penalties against Russia.

Meanwhile, since it has hampered its own energy production, the United States is unable to help Europe much at this crucial moment.

Until a few months ago Gov. Ned Lamont, a Democrat, and many Democratic state legislators sought to raise Connecticut's gas tax invisibly through a regional scheme to raise wholesale gas taxes without providing people with any transportation alternatives, though cars are a necessity for most in a state as suburban as Connecticut.

The explosion in gas prices and inflation has prompted the governor and those Democratic legislators to shelve their hidden gas tax idea. But the Democrats long have been Connecticut's tax-raising party and bear most responsibility for making the state so expensive to inhabit -- and for what? Are the state's cities any less destitute and violent? Are its poor any more self-sufficient? Are its socially promoted children any better parented and educated?

Or is inflation the main result of policy on the state level too?

Chris Powell is a columnist for the Journal Inquirer, in Manchester.

Don Pesci: May we be worthy of the brave Ukrainians

Albert Camus

VERNON, Conn.

In March, 1957, the French novelist and philosopher Albert Camus (1913-1960) published an essay, at great cost to himself, titled “{Janos} Kadar Had His Day Of Fear.” His epitaph on the Soviet-suppressed Hungarian Revolution, in the fall of 1956, may serve as well as an epitaph on the Ukraine’s democratic revolution, which Russian dictator Vladimir Putin is now trying to destroy. Kadar (1912-1989) was the Communist boss of Hungary, reporting to his Soviet bosses.

The Hungarian Revolution was suppressed at the order of the Kremlin, run by its then boss, Nikita Khrushchev, after Stalin had installed in Hungary a Communist dictatorship after World War II. Camus regarded the takeover of Hungary by totalitarian Stalinists as a counter-revolution.

His essay was costly to Camus for a number of reasons. It was an epistle of liberty and a resolute, unambiguous disparagement of totalitarianism.

The essay began on a defiant note: “The Hungarian Minister of State Marosan, whose name sounds like a program, declared a few days ago that there would be no further counter-revolution in Hungary. For once, one of Kadar's Ministers has told the truth. How could there be a counter-revolution since it has already seized power? There can be no other revolution in Hungary.”

And the second paragraph likely was considered in France by what we might call its philosophical establishment as an awakening slap in the face: “I am not one of those who long for the Hungarian people to take up arms again in an uprising doomed to be crushed under the eyes of an international society that will spare neither applause nor virtuous tears before returning to their slippers like football enthusiasts on Saturday evening after a big game. There are already too many dead in the stadium, and we can be generous only with our own blood. Hungarian blood has proved to be so valuable to Europe and to freedom that we must try to spare every drop of it.”

And then France’s apostle of liberty let loose the following thunderbolt: “But I am not one to think there can be even a resigned or provisional compromise with a reign of terror that has as much right to be called socialist as the executioners of the Inquisition had to be called Christians. And, on this anniversary of liberty, I hope with all my strength that the mute resistance of the Hungarian people will continue, grow stronger, and, echoed by all the voices we can give it, get unanimous international opinion to boycott its oppressors. And if that opinion is too flabby or selfish to do justice to a martyred people, if our voices also are too weak, I hope that the Hungarian resistance will continue until the counter-revolutionary state collapses everywhere in the East under the weight of its lies and its contradictions.”

Camus himself was both an atheist and a socialist fully prepared to take to the ramparts, in fine French fashion: “For it [the Stalinist false front] is indeed a counter-revolutionary state. What else can we call a regime that forces the father to inform on his son, the son to demand the supreme punishment for his father, the wife to bear witness against her husband —that has raised denunciation to the level of a virtue? Foreign tanks, police, twenty-year-old girls hanged, committees of workers decapitated and gagged, scaffolds, writers deported and imprisoned, the lying press, camps, censorship, judges arrested, criminals legislating, and the scaffold again—is this socialism, the great celebration of liberty and justice?”

Here at last was a man who knew how to draw proper distinctions. The essay was bound to tread on tender toes.

In Hungary, a Joshua horn had been sounded, and walls had begun to tumble: “Thus, with the first shout of insurrection in free Budapest, learned and shortsighted philosophies, miles of false reasonings and deceptively beautiful doctrines were scattered like dust. And the truth, the naked truth, so long outraged, burst upon the eyes of the world.

“Contemptuous teachers, unaware that they were thereby insulting the working classes, had assured us that the masses could readily get along without liberty if only they were given bread. And the masses themselves suddenly replied that they didn't have bread but that, even if they did, they would still like something else. For it was not a learned professor but a Budapest blacksmith who wrote: ‘I want to be considered an adult eager to think and capable of thought. I want to be able to express my thoughts without having anything to fear and I want, also, to be listened to.’"

It was an essay too far for many stern socialists in France, some of whom were prepared to avert their eyes so long as the Soviet experiment in Russia moved forward unimpeded.

Camus stood in the way of totalitarian progress. He was of the party of liberty and just revolt. As such, he ended his essay: “Our faith is that throughout the world, beside the impulse toward coercion and death that is darkening history, there is a growing impulse toward persuasion and life, a vast emancipatory movement called culture that is made up both of free creation and of free work.

“Our daily task, our long vocation is to add to that culture by our labors and not to subtract, even temporarily, anything from it. But our proudest duty is to defend personally to the very end, against the impulse toward coercion and death, the freedom of that culture—in other words, the freedom of work and of creation.

“The Hungarian workers and intellectuals, beside whom we stand today with so much impotent grief, realized that and made us realize it. This is why, if their suffering is ours, their hope belongs to us too. Despite their destitution, their exile, their chains, it took them but a single day to transmit to us the royal legacy of liberty. May we be worthy of it!”

Don Pesci is a Vernon-based columnist.

‘Glad of the burn’

“The Magpie,’’ by Claude Monet (1869)

Preston City Congregational Church

“I crouch down in blank

snow, glad of the burn

of cold air in the west,

the border of trees

black and still.’’

— From “Beginner’s Mind,’’ by Margaret Gibson (born 1944). She’s poet laureate of Connecticut and an emeritus professor at the University of Connecticut. She lives in Preston, Conn.

In the Hallville Mill Historic District, in Preston.

Information below is mostly an edited-down version of a Wikipedia entry on Preston.

“Properties in the district include 25 structures on a 50-acre site. The district includes the dam forming Hallville Pond (a mill pond — above), historic manufacturing buildings and worker housing, and the Hallville Mill Bridge, a lenticular pony truss bridge built circa 1890 by the Berlin Iron Bridge Co.

“The first mill there was built in 1752 for finishing locally produced homespun woolen cloth, with carding machines added in the early 19th Century.

“In 1857 Joseph Hall Sr., a weaver born in England, built an industrial-scale woolen mill on the site. The mill remained under his family's ownership under the name Hall Brothers' Woolen Mill (named for the founder's sons) and was expanded over the years. As of 1888 the mill employed 175 workers and produced 860,000 yards of cloth annually. The mill burned down in 1943, but manufacturing continued in Hallville until the 1960s and was a major source of employment and tax revenue for Preston.’’

It’s a classic small New England mill town. Sadly, the huge and sleazy Foxwoods casino is all too close, in Ledyard.

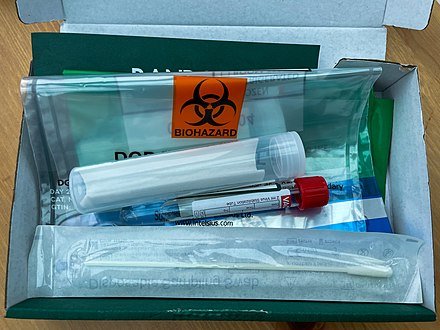

Amazon octopus keep stretching out its arms

Goodyear Metallic Rubber Shoe Company and downtown Naugatuck (c. 1890). The many industrial firms in Naugatuck and Waterbury in the communities’ industrial heyday, from the mid-19th Century through the 1960’s, dumped toxic waste into the Naugatuck River, much of which eventually flowed into Long Island Sound.

From The New England Council (newenglandcouncil.com):

“Amazon plans to develop a new distribution facility in New Haven County, Conn….Bluewater Property Group, a developer from Pennsylvania, has begun taking steps to create a tremendous Amazon distribution facility on the border of Waterbury and Naugatuck.

“Though the development is far from completion and is awaiting approval, residents of Waterbury and Naugatuck and members of the Connecticut (congressional) delegation are optimistic about the prosperity that this facility would bring to the county, and even the state.

“‘It has the potential to create up to 1,000 new jobs and go a long way in supporting these communities in their broader revitalization efforts,’ stated Connecticut Gov. Ned Lamont. U.S. Rep. Jahana Hayes shared in this assertion, stating that this influx of jobs would benefit the middle class and the blue-collar workers in the area.’’

Makes you love winter, at least for a few minutes

A gorgeous morning on the estuary in Rowayton, Conn., on Jan. 30 after the beautiful if inconvenient snowstorm the day before.

— Photo by Hilary Cosell

Nothing good about being a good loser?

Red Auerbach on the bench next to rookie Bill Russell during a game at the old Boston Garden, Dec. 26, 1956. Bob Cousy can be seen in the background.

“Show me a good loser, and I’ll show you a loser.’’

— Arnold “Red’’ Auerbach (1917-2006), legendary and highly successful head coach (1950-1966), and then general manager, of the Boston Celtics.

xxx

“Part-time information and full-time opinions can be very dangerous.’’

{Even in sports?}

— Chris Berman (born 1955), a sportscaster for ESPN (originally short for Entertainment and Sports Programming Network) virtually since ESPN was launched, in 1979, as one of the first major cable-TV networks. It has been based since its founding in Bristol, Conn.

ESPN’s palatial headquarters, in Bristol, Conn.

— Photo by Jkinsocal

American Clock and Watch Museum, in Bristol, which, like Waterbury, Conn., was a major maker of clocks.

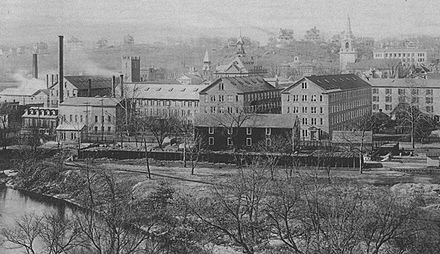

Chris Powell: $75 million could be spent better; stop hysteria over COVID home testing

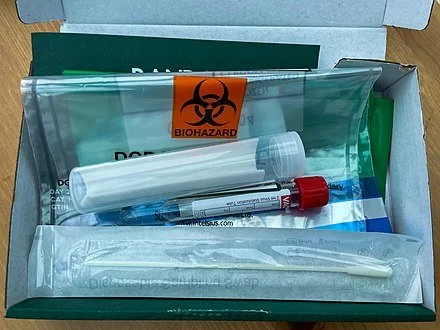

COVID-19 home test kit.

MANCHESTER, Conn.

Connecticut Gov. Ned Lamont could have found worse things to do with the $75 million in federal emergency aid he ordered distributed last week as a bonus to poor households receiving the state's earned-income tax credit. On average those households probably have suffered more financially from the long virus epidemic, since many of their breadwinners hold, or held, the service-sector jobs that were the first to be cut back or eliminated.

Complaints from Republicans that the bonuses mainly will reward a constituency of the governor's party, the Democrats, as his re-election campaign begins are not so compelling. For nearly everything government does rewards some political constituency, and state law already had identified the earned income tax credit constituency as deserving. If Connecticut ever again has a Republican administration, it will be unusual if Republican-leaning constituencies -- if only ordinary taxpayers -- are not rewarded too.

The governor's dispensing that $75 million is troublesome for different reasons, starting with the disregard for democratic procedure.

The governor's office says the federal law that sent the emergency money to the state authorizes his administration to spend it on expenses incurred because of the virus epidemic. But the state has been paying its earned income-tax-credit obligations all along. No payments by the government were cut because of the epidemic. While many recipients surely suffered losses because of the epidemic, it's unlikely that all did, and no one receiving the bonus will have to show evidence of such losses. The expenses to be reimbursed here are merely being assumed.

Additionally, $75 million is a lot of money for state government to dispense out of the blue at the command of just one official, an amount never formally appropriated by the General Assembly. Indeed, as Republican legislators note, state law already had determined how much was to be spent on the tax credit. The bonus created by the governor overrides that legislation.

Since he still exercises -- at least until February -- emergency powers to rule Connecticut by decree, the governor presumably could have rewritten the tax-credit law by himself to authorize the bonus. But he did not do so, perhaps because it might have emphasized his gathering unnecessary power to himself.

Republican legislators note that Connecticut faces many other compelling needs apart from those of the tax-credit recipients and that ordinary democracy first would have summoned the legislature or legislative leaders to discuss how to spend the $75 million. That's why the governor's high-handedness here is another argument for letting his emergency powers expire.

Having continued for two years, the virus epidemic is no longer an emergency. While the epidemic will wax and wane as epidemics do, government is fully aware of what combating it may require. Most of all, combating it may require more medical facilities and staff, and thus, to finance them, fewer raises for government employees, fewer stupid imperial wars and that $75 million that instead will be spent to expand the tax credit.

That money might build a few hospital wards and hire more doctors, nurses, and auxiliary staff. It might buy and distribute antivirals and vitamins.

If the tax-credit bonus can be construed as an expense of the epidemic, surely expanding medical capacity and services could be construed similarly. With so much free money flowing from Washington, the federal government probably wouldn't object if Connecticut chose to get more relevant.

After all, unlike the tax-credit bonus, increasing medical capacity might benefit everyone who got sick.

Meanwhile government's frantic efforts to distribute home testing kits for the virus and the public's frantic efforts to obtain them seem misplaced.

Surely quite without a test most people can tell if they are sick with symptoms like those attributed to the virus, and surely most people with such symptoms might have enough sense to get to a doctor or hospital quickly, especially since early treatment of the virus is crucial to defeating it.

The people lately waiting in long lines for a home test kit for the virus well may be putting themselves at greater risk of contracting it. The virus is bad enough. Test hysteria induced by government will make it worse.

Chris Powell is a columnist for the Journal Inquirer, in Manchester.

Happy in Connecticut

Seal of Southbury, Conn

"I came to Southbury because I wanted to live a more simple life. When I was a child, I saw lots of movies about happy people living in Connecticut. And ever since then, that was where I wanted to live. I thought it would be like the movies. And it really is. It's exactly what I hoped it would be.’’

— Polly Berger (1930-2014), actress, singer, writer and TV host

Audubon Center Bent of the River Trail in Southbury.

—Photo by Karl Thomas Moore

Going their own ways

In the Litchfield Hills: Bridgewater, Conn. — houses, farms and fields, as seen from Brookfield

— Photo by Liam E

“The Yankee mind was quick and sharp, but mainly it was singularly honest.’’

— Van Wyck Brooks (1886-1963), once-famous historian, biographer and literary critic, in The Flowering of New England

He spent much of his life in Bridgewater, Conn., long a weekend and summer place for affluent New Yorkers

xxx

“Whoso would be a man must be a nonconformist.’’

— Ralph Waldo Emerson (1803-1882), world-renown essayist, lecturer, philosopher, abolitionist and poet. He spent most of his life in what we now call Greater Boston.

Chris Powell: Why it’s so tough to reduce domestic violence in our disintegrating society

Cycle of abuse, power and control issues in domestic-abuse situations

— Graphic by moggs oceanlane

MANCHESTER, Conn.

Connecticut, the state's Hearst newspapers found this month in a series of investigative reports, has not made much progress solving its domestic- violence problem. Of course studies of the state's other major problems might reach a similar conclusion, but one has to start somewhere.

Connecticut's main response to domestic violence is the protective order, with which a court warns an allegedly abusive party to stay away from the party who feels abused. The dark joke has been that every woman murdered by her husband or boyfriend dies clutching a protective order. That is, protective orders aren't terribly effective, as the Hearst series showed.

The series found that a protective order had already been issued in a quarter of the 15,500 domestic violence incidents reported to police in Connecticut in 2020. A fifth of domestic violence charges in the state's courts from 2016 to 2020 involved at least one violation of a protective order, and many of those charges were dismissed. Only about 20 percent of the 23,000 protective-order violations charged in those years resulted in convictions.

Most of those charges were resolved by plea bargains or the referral of the accused to a rehabilitation program.

And so about 300 people, mostly women, have been killed by domestic violence in Connecticut in the last 20 years. Many more have been injured.

The data call for more vigorous enforcement. But then so do the data for most crimes in Connecticut. For all criminal justice is a system of discounting charges via plea bargains and probationary programs, because there is far more crime than resources to prosecute them and because Connecticut's criminal-justice system strives most of all to keep perpetrators out of jail.

Other than domestic violence, it is hard to find any serious crime in Connecticut where the defendant doesn't already have a long criminal record but has remained free or suffered only short imprisonment, since the state lacks an incorrigibility law.

The Hearst series reported that domestic violence cases are discounted in court more often than equally serious crimes, but this is misleading, for domestic violence cases can be more difficult to prosecute. More of their evidence is uncorroborated testimony -- "he said, she said" cases -- more of their accusers lose the desire to testify, and fewer of the accused have long records indicating a danger to anyone besides their accusers.

As the stream of domestic violence deaths and injuries suggests, protective orders, rehabilitation programs and social workers are no substitute for speedy trials, convictions, and imprisonments. Meanwhile, there is always infinite demand for government to protect people against all the risks of life.

But government can't protect everyone from everything all the time, and, distracted by the virus epidemic, government now is less able to protect everyone from even ordinary threats. Until Connecticut is ready to prosecute, convict and imprison abusers quickly or to hire round-the-clock bodyguards for everyone threatened by domestic violence, people will have to be ready to protect themselves and take some responsibility for the awful partners they have chosen.

It's an unpleasant thought, but then nothing is gained by ignoring the social disintegration worsening all around, of which domestic violence is only one part.

xxx

Responding to recent commentary in this space, a reader writes that if Bob Stefanowski can get next year's Republican nomination for governor without a primary, he has a chance to beat Gov. Ned Lamont. But if Stefanowski has to run in a primary, "he will have to kiss up to every Trump-supporting, gun-toting, anti-abortion nut in the Republican Party" and then the nomination will be worthless.

Another reader counters: If Governor Lamont wins renomination by the Democrats without a primary, he has a chance to beat Stefanowski. But if Lamont faces a primary, "he will have to kiss up to every AOC-Squad-supporting, illegal-gun-toting, pro-abortion nut in the Democratic Party," and then his nomination will be worthless.

Yes, both parties have extremes that can dominate their primaries, and the governor has done a fairly good job tiptoeing away from his party's crazy left. Can Stefanowski get around his party's crazy right?

Chris Powell is a columnist for the Journal Inquirer, in Manchester.